Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. Register here to read this month's Aimzine |

In December 2010 AimZine reported how Bango had seen significant growth in demand from application stores but was experiencing delays in its traditional business. On 28 February Bango issued a further Trading Update which reported that its traditional business had not recovered as expected and that profits for the current year would be impacted. We reproduce two paragraphs from the RNS below:

‘While Bango is seeing positive results and growth from the RIM project and other "App Store" opportunities, which remain our key focus for Bango payments and analytics for the coming year, indications for February and March are that the traditional "content aggregator" business is not showing the expected signs of recovery.’

‘The continued decline in the "high volume, low margin" traditional business, coupled with an expectation that revenues from the next significant App store business will begin in the first half of next year (rather than in March) means we expect that the financial outcome for the year ending 31 March 2011 will be lower than market forecasts.’

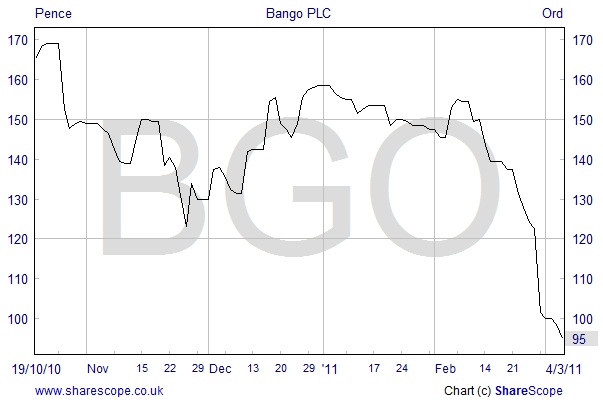

In the statement (which can be read in full here) Bango appear very optimistic about the ‘App Store’ business in the longer term. They also state that the magnitude of the RIM (Research in Motion - owners of the Blackberry product line) relationship is transformational for Bango. However, Bango’s shares have been impacted by news of a short term reduction in expectations – see graph below.

We contacted Bango’s CEO, Ray Anderson for some further information on the trading news. From Ray’s answers (in blue) to our queries below it is clear that the RIM business has a lot of potential for Bango.

Ray Anderson

Bango's shares impacted

by the news

1. |

In the trading update you refer to the decline in the traditional business. Could you remind our readers what this business is and why it has declined?

|

|

Our business has grown traditionally by providing services that enable people selling content and services ‘direct to consumer’ through their own mobile websites, as opposed to placing their content in App Stores or mobile operator portals. |

2. |

In the trading update you say that you will be carrying out a review of the traditional business. Can you say any further about such a review at this stage?

|

|

We currently spend time and money helping our larger customers to expand their business, by provision of advice, technical functionality and contacts with new marketing partners. If, on review, we determine that the return on that spending is not attractive, we may decide on a different model. For example, it may be better to assist them to leverage the growth in App Stores.

|

3. |

The RIM business sounds exciting for Bango. Can you say how many carriers and vendors are connecting to the Bango platform?

|

|

RIM prefers to announce their progress directly. However, the following facts have been announced, Bango has 57 carrier connections today (see bango.com/rates) and we are connecting many of these and some new carriers to support the RIM roll-out. All Blackberry App World vendors are connected to Bango - RIM have announced there are thousands - and hundreds of vendors are making sales every month through Bango.

|

4. |

Can you say more about how growth from the RIM business will come on board for Bango? E.g. Will you be converting vendors (and carriers) for some years.

|

|

There are hundreds of carriers to integrate, each of which brings new users and more transactions. In addition, the volume and value of applications sold is expected to rise, and the number of Blackberry users continues to rise rapidly, with millions of new users coming on board every quarter.

|

5. |

Has Cenkos updated its forecasts following the Trading Update?

|

|

Yes, revised forecasts are available – (see below).

|

6. |

Will the delays referred to in the trading update have a major impact on cash resources?

|

|

No significant impact. We have sufficient cash reserves for the foreseeable future and the growth, or otherwise, in the traditional business does not consume cash.

|

The revised broker forecasts are:

|

Revenue (£m) |

Pre tax profit |

Adjusted* EPS (pence) |

Year to 03/11 |

19.7 |

(0.3) |

(0.1) |

Year to 03/12 |

73.1 |

2.0 |

6.4 |

*pre amortisation and share option costs

AimZine will continue to monitor progress at Bango in the regular monthly Featured Companies Update article.

millions of new users coming

on board every quarter

Copyright © Aimzine Ltd 2011

y without prior consent. ADVFN will BAN those who post AIMZINE articles without prior permission.

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |