AIM Snippets

This month in our trawl through hundreds of RNS statements we have ‘landed’ a complex looking situation in Georgica. This Aim-listed company is the operator of 38 tenpin bowling sites.

We recommend that readers do some research into Georgica, but we should warn that there is quite a bit of reading material to digest. Hence, this may not appeal to those who are ’time-poor’.

We will start with a background paragraph from a recent Group document:

‘Georgica was formed in 2000 as an investment vehicle for the purpose of acquiring the entire issued

share capital of Allied Leisure Plc through a public takeover bid. The bid became unconditional as to acceptances in October 2000 and the acquisition was completed in January 2001. Until the sale of its cue sports business on 28 August 2007, Georgica was one of the UK’s largest indoor leisure companies. The Tenpin Bowling Business now consists of Georgica’s wholly owned tenpin bowling operation, comprising 38 leasehold sites and a portfolio of five former Rileys properties identified to offer redevelopment opportunities.’

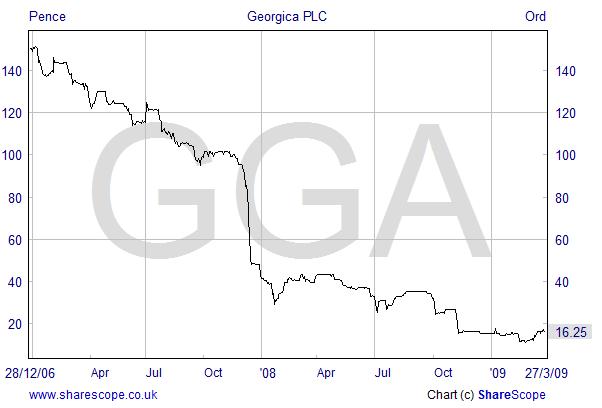

On 10 March Georgica issued its Final Results for the year to December 2008. These showed earnings before interest, tax, depreciation and amortisation (EDITDA) for the operating business amounted to £6.6 million. The loss before tax was £44.5 million. This followed a number of ‘depreciation and impairment’ reviews and some non-recurring items. Business has been tough for Georgica in recent months because they have seen reduced spending during the current economic slowdown. However, the Group has remained profitable and cash generative but Georgica’s shares have suffered as can be seen from the chart below. This shows a fall of almost 90% in the last 2 years.

the Group has

remained profitable

and cash generative

Georgica has been busy reducing its debt over the last 2 years. At its peak in 2007 net debt was £99.5 million. This has been reduced down to just £0.7 million at 28 February 2009.

At the closing mid market price of 16.25 pence on 27 March Georgica has a market capitalisation of just £15.8 million.

Now for the interesting (and rather complex) news: Georgica announced on the same day as its results that it was proposing to undergo a reorganisation in order to facilitate the return of cash to shareholders. Subject to a court meeting in April, Georgica will be established as a wholly owned subsidiary of a new parent company to be named ‘Essenden’. This new company will be listed on Aim from the end of May. Shareholders will receive 1 Essenden share and I Essenden ‘Note’ for every 5 Georgica shares held. The Essenden Notes will be Plus-listed.

The company explained the Notes by saying: ‘The Georgica Board considers that issuing the Essenden Notes will make it easier to return cash through the redemption or purchase in the market by Essenden of the Essenden Notes. The Essenden Notes will be £1 principal amount, zero coupon, perpetual notes ranking pari passu amongst themselves and pari passu with all other unsecured and unsubordinated obligations of Essenden. The Essenden Notes will be fully repayable at par on the occurrence of certain specified events, including a change of control, an insolvency event or a change in operating activity.’

We recommend that investors interested in Georgica should study the following documents:

- 2008 Final Results Scheme of Arrangement Document

- Essenden Admission Document

All three documents can be accessed from the Georgica website here.

Obviously there are risks to the Georgica business in the current environment. However, the business has been profitable and cash generative up until now. Furthermore, we do not think the directors would have gone to all the trouble of restructuring the business to return just a few pence per share. We are further encouraged by seeing these two well known value seekers named as Georgica’s largest two shareholders:

North Atlantic Value 27.77%

Trefick Limited 21.33%

As if to emphasise its enthusiasm for returning cash, Georgica has recently been purchasing its own shares in the market. This seems to have caused the share price to tick up a few pence during March. We look forward to watching developments with Georgica and Essenden.

NB. Anyone holding Georgica shares in May is likely to receive Plus-listed Essenden Notes. Be aware that some Stockbrokers’ nominee accounts may not be accept such Notes. If in doubt, speak to your broker.

Georgica ........

is proposing to

undergo a

reorganisation in

order to facilitate

the return of cash

to shareholders

If you would like to comment on this article please click here

Written by Michael Crockett

Copyright Aimzine Ltd

RETURN TO AIMZINE NEWSLETTER HOME | April 2009

’

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |