Sagentia: Collective Technology Wisdom

RETURN TO AIMZINE NEWSLETTER HOME | April 2009

Worthy of Further Investigation

In today’s downtrodden markets there are many companies whose shares appear to be quoted at an extremely low level. At the beginning of March, AIM-listed Sagentia released their results for the year to 31 December 2008. These results showed ‘shareholder funds per share of 71.9 pence’ which is approximately four times the current share price. It would seem that the Group’s assets are fairly valued and that the company is trading reasonably well. Sagentia is therefore worthy of further investigation.

Early in March I joined a financial media visit to Sagentia’s headquarters which is located on a greenfield site at Harston, close to Cambridge. Its headquarters are most impressive, based around the site of an old water mill. Surprisingly, this Aim-listed company with a market cap of just £3.5 million own the freehold of this extensive Harston Mill site.

Although the market capitalisation is low, Sagentia is not that small a company having over 200 employees. The Group is quite complex which must in part explain the low valuation. In this article today we will introduce the company and consider its recent results and prospects. In the next edition of Aimzine we hope to carry an article written by Sagentia explaining some of the Group’s key technologies.

The Business

Sagentia describes itself as a ‘leading international technology consulting, product development and intellectual property licensing organisation’. In other words it does ‘clever things’ for other companies. Over 75% of the Group’s employees are technology consultants. Chief Executive, Alistair Brown, explained that most Sagentia technologists have extensive industrial experience as well as being highly qualified, a great many to PhD level.

Most of Sagentia’s business today is in providing consultancy for its clients. In addition, it has a small number of projects where it is exploiting its own Intellectual Property (IP). Alistair Brown intimated that he is keen to grow this IP side of the business where the higher margins are attractive.

In addition to this Consulting and IP core business, Sagentia has stakes in a number of venture subsidiaries (where Sagentia has a majority shareholding) and equity investments (minority holding). Sagentia has been involved in the early stages of many these small companies.

Whist some of these companies seem to hold considerable promise others have performed poorly. The Group has stated it is looking to dispose of its venture subsidiaries and equity investments as suitable opportunities arise.

Sagentia CEO: Alistair Brown

Sagentia does ‘clever things’ for other companies |

Harston Mill

Approximately 200 of Sagentia staff are employed at Harston Mill utilising about half of the 77,000 square feet freehold premises. The remainder of the offices and laboratories at Harston Mill are let out to a number of small companies whose staff total just over 200. Many of these companies are the venture subsidiaries and equity shareholdings referred to above.

The Harston Mill site is fully occupied and with some tenants looking to expand there is certainly no immediate prospect of expensive unoccupied property for Sagentia.

Recent Changes

Up until last year Sagentia was listed on the Main Market in London whilst being incorporated in Switzerland. In July 2008 the Group transferred its listing to AIM and moved its domicile to the UK.

These changes taken with the re-focussing of the business on its core consultancy and IP activities should help Sagentia’s investor profile.

Alistair Brown was appointed as CEO in 2008 and he set a new strategy for the company developing the Group’s strengths and moving away from venture creation and spin-outs. Certainly with these changes and some notable recent successful projects Sagentia does seem to be entering a more positive phase, as shown by the significant improvements in performance of the core consulting and IP business.

The Shares

To date Sagentia’s changes and improvements have yet to have a positive effect on the share price. Since listing on AIM in July 2008 the shares have fallen from 45 pence to under 20 pence. This is a disappointing performance but much of this fall will have been caused by the extraordinary weakness in the markets, particularly AIM, over recent months.

Part of the Harston Mill Site

Sagentia, as Generics Group, was originally floated on the main market in 2000 raising £46 million in the Initial Public Offering. This was at the time of the tech boom and, like most of its technology peers, the shares suffered a considerable fall in the shakeout which followed.

Sagentia’s largest shareholder is Catella who own 48.95% of the issued share capital. This Swedish Finance Group purchased its stake back in 1996.

Sagentia Group at a Glance |

|

+ Share price is a fraction of net asset value |

|

+ Core operations growing and profitable |

|

+ Benefitting from recent restructuring |

|

+ Many on-going successful projects |

|

+ Forward P/E Ratio < 4 |

|

- Previously complex Group structure not well understood by market |

|

- Significant shareholder owning 48.9% of shares |

|

- Some investments have performed poorly |

- Historically weak share performance |

Innovation

At the media day I attended, we were treated to a number of presentations and demonstrations of technologies recently developed by Sagentia with and for its clients. The photographs to the right of this article are examples of some recent products.

Sagentia has been involved in some very clever and successful developments. Its approach is to work in multi-disciplined project teams which it claims ‘stimulates innovation and the creation of richer solutions that may have been considered impossible or off the radar completely’. Sagentia have named (and trademarked) this approach as ‘Collective Technology Wisdom’.

Next month we will be publishing an article by Sagentia describing some of its technology successes. For this article today I will highlight just two projects. These two, M-Pesa and a project for Master Meter Inc are particularly commercially significant.

M-Pesa is a technology developed by Sagentia for Vodaphone which allows users to transfer money securely using a mobile phone. The service, designed for countries where most people do not have bank accounts and where holding money can be unsafe, was launched in Kenya in 2007 linked to the local Safaricom network. The service has subsequently been deployed in Tanzania and Afghanistan with other ‘significant markets’ under development.

M-Pesa is proving to be a big success and is already recording over 1 million daily transactions. Sagentia has a team of 50 people working on M-Pesa. With product enhancements and further roll-outs in the pipeline prospects here look very good.

Sagentia has developed an eight wheel water meter for US water meter giant, Master Meter which enables remote meter reading. In its recent results Sagentia state: ‘During a two-year development process, in which Sagentia reduced the tooling outlay by 90 percent, a change in design allowed Master Meter to adopt new IP as the basis for its sensing principle and so protect its product from duplication. Master Meter signed an exclusive license deal with Sagentia for the use of this technology. The project generated more than US$1 million in consulting fees and we expect the ongoing license deal for the core technology to generate US$4.5 million for the Group in total over a number of years.’

The Master Meter product was developed using Sagentia’s ‘Grey Wheels’ proprietary IP. Quoting again from the results: ‘Sagentia holds substantial interests in IP assets, usually in the form of licenses and/or equity stakes in exploitation vehicles which should start to generate non-consulting income over the next few years.’

Venture Subsidiaries and Investments

Sagentia holds minority equity stakes in a small number of companies – these stakes were valued at £3.9 million at 31 December 2008. Also, the Group owns majority stakes in some spin-out Venture subsidiaries – these holdings were valued at £1.5 million at 31 December 2008. To get a better understanding of these investments we recommend reading the Financial Review in the recent results which can be downloaded here.

Two of Sagentia’s minority equity stakes referred to above were in AIM-listed companies both of which have disappointed. Since the 2008 year end Sagentia has sold its holding in one of these, CMR Fuel Cells. The second AIM-listed company, Turftrax, has had its shares suspended as it has had problems raising finance. However, a recent announcement anticipates progress here. Some of the other (unlisted) minority stake companies seem to be performing well. Sphere Medical (Sagentia 7%) in particular seems to have exciting prospects.

Sagentia holds

minority

equity stakes

in a small number

of companies

Numbers

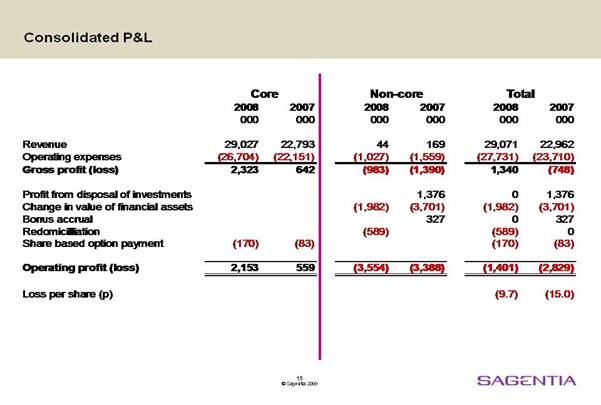

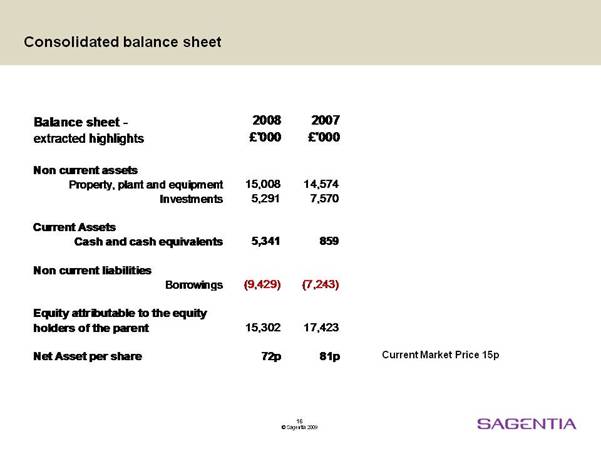

In this section we have used two slides from a Sagentia presentation. We strongly encourage readers wishing to understand Sagentia’s value to study these slides.

The under-performance of investments caused partly by extra-ordinary market conditions has severely impacted Sagentia’s results for the last two years as the following slide shows:

Note: Sagentia’s year end is December 31

Looking at the 2008 non-core figures above: The £1,027,000 was relating to expenses of majority owned subsidiaries and £1,982,000 was a non-cash write down in the value of the Group’s equity investments. Without these 2 items and the re-domiciliation exceptional charge Sagentia would have reported an operating profit in excess of £2 million.

The second slide shows extracted highlights from the balance sheet. Most of the large ‘Property Plant and Equipment’ figure relates to the Group’s Harston Mill site - this site was valued in August 2008, in a sale and leaseback scenario, at £13.75 million. The majority of the £9.429 debt is secured against the Harston Mill site. £9.0 million of this debt is a 5 year loan dating from March 2006 approximately half of which is secured at a very low Base + 0.8%.

Note that there are no intangible assets included in these balance sheet assets. Even the $4.5 million anticipated from the Master Meter project is not held on the balance sheet.

Looking forward, Sagentia’s broker is forecasting profits of £1.3 million for the year to 31 December 2009 on turnover of £25.3 million giving earning per share of 4.5 pence. With the share price currently under 20p this gives a p/e ratio of approximately 4.

Sagentia Products Examples:

Investment Considerations

With assets in excess of 70 pence per share and a profitable and growing business it would seem that Sagentia is seriously undervalued. However, particularly in today’s weak markets, there is no guarantee that this position will not prevail and could even deteriorate further.

There are many factors that have caused the shares to reach these low levels and these include:

- Difficult to understand business with a mixture of investments and subsidiaries.

- Years of share price decline

- Swiss domicile

- Write downs of underperforming investments

- Recent extraordinary weakness in Small Cap shares

- Concern about the large Catella shareholding

There is no doubt that things are changing at Sagentia. The change to an AIM listing and the move to a UK domicile along with the sale of underperforming assets have been major positive steps (Although many shareholders may not have been happy to see the write offs on such as CMR). However, the shares have shown continued weakness in spite of recent progress.

The current financial year will see a considerable reduction in the spending on non-core assets and will see some benefit (rather than the 2008 charge) from the re-domiciliation. The broker forecast of earning per share of 4.5 pence for the current year gives a forward p/e of under 4. Whilst there must be risks to this forecast in the current climate, the 2008 results were strong and the demand at the end of the year was described as ‘robust’.

So long as reasonable results can be delivered a re-rating should be on the cards in the not too distant future. We will be particularly keen to see the interim results to monitor progress.

Written by Michael Crockett, Aimzine

Copyright © Aimzine Ltd 2009

RETURN TO AIMZINE NEWSLETTER HOME | April 2009

|

||