On 10 May Advanced Power Components issued its Interim results for the six months to 28 February. These showed an improving position, with the Company reporting profit before tax of £42,000, compared with a loss before tax of £281,000 in first half of 2009. Chief Executive, Mark Robinson, reported: ‘We are pleased with the progress made during this six month period, which has seen the Company return to profitability. Economic conditions have not yet fully recovered, however improved trading, coupled with the cost saving measures we have introduced and the exciting progress we are making in a number of areas, lead us to be guardedly optimistic about the future.’

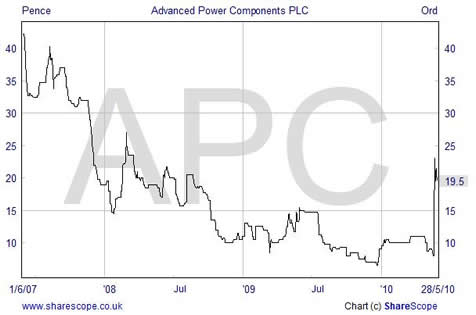

APC’s share price has suffered over the last three years as the Company has been hit by the recession, exacerbated by problems with exchange rate losses in the 2009 financial year. The shares, which were over 40 pence, in 2007 can now be bought for less than 10 pence**. With the CEO expressing some optimism for the future, could this be the time for investors to look further at APC? Aimzine contacted Mark Robinson with a number of key questions. Mark’s responses below are encouraging. In particular his comments on debt reduction in Q4 and information on plans for the ‘imop’ in Q9 are noteworthy.

**We wrote this article on 19 May. Since then APC's share has more than doubled following a tip from 'Red Hot Penny Shares'. We would not be surprised to see more tipsters follow this lead.

Mark Robinson

1. The Chairman stated in APC’s recent Interim results: ‘General market conditions appear to be stabilising and we are currently seeing an increasing level of longer term opportunities.’ Can you say more about the longer term opportunities you are seeing and whether this marks the end of the difficult trading environment?

Trading has certainly stabilised and we have implemented some careful cost-cutting measures, which, along with foreign exchange hedging mechanisms, have enabled us to return to profitability. It is too early to say whether the difficult trading environment is coming to an end; however, the Company is now much leaner and more efficient, making it well placed if economic conditions remain difficult, but equally, due to our careful consideration of where these savings have come from, it is well positioned to take advantage as the market improves. The longer term opportunities we are seeing are the result of a lot of behind-the-scenes work over the last two years to establish ourselves in new sectors or with new technologies. We’ve focused a great deal of effort on establishing new business in power management, high efficiency lighting, wireless communications, high frequency electronics and environmentally friendly technologies and expect that we will see revenues generated from each of these areas over the next 12 months.

2. In the results there is a list of APC’s eight areas of activity. Has trading improved in all eight areas? Or are there some areas that remain weak?

The more commercial / industrial APC Hero, APC Displays+ and APC Go! areas of our business were hardest hit during the downturn but these are now bouncing back. APC Hi-Rel remained steady as this unit principally serves the defence and aerospace sectors which have been relatively sheltered from the recession. APC Novacom, our microwave and RF unit, is currently the best performing area of the business, possibly because it’s very technical and offers the biggest opportunity for us to add value.

3. Can you highlight any areas where you are particularly optimistic about prospects?

We have seen improvement in all areas of activity and are working hard to ensure that performance continues to improve across all of our business units.

As mentioned earlier, we see LED lighting and wireless communications as two potentially strong growth areas and we are looking to increase our activity in these sectors. We have also entered into the green tech market, with our imop product (see Q9 below). This product has sparked interest from a wide range of different industries internationally and we are optimistic about prospects here, although at this early stage it is difficult to estimate the impact it may have on revenues - this area of the business has not been factored into our forecasts.

4. You have reported additional loans and increased invoice discounting. Can you give a breakdown and details of current loans?

.

We have taken steps to strengthen our balance sheet with the issue of some convertible loan notes, reducing debtor days and inventory levels and, as a result, are now paying creditors more promptly. Working closely with the bank, we extended our borrowing facilities by taking on a limited amount of fixed term debt and increasing the headroom on the invoice discounting facilities. In reality, the additional headroom has not been utilised as we are already reducing our overall borrowing and intend to continue to do so in the short to medium term.

5. To what extent are your growth prospects limited by a shortage of funds? And are you still considering further acquisitions?

.

We have always been an ambitious company; however, during the downturn, our focus necessarily switched to cost cutting and protecting our existing business. Although we are always monitoring opportunities, acquisitions are unlikely in the very short term as we are instead focused on the opportunities which we have already developed. However, we remain ambitious and will consider further acquisitions in the medium to long time frame should the right opportunity present itself.

6. APC had problems with exchange rate losses in FY 2009. Can you explain the controls that have been put in place to reduce the exposure to exchange rate fluctuations?

We have engaged a number of foreign exchange hedging policies which are designed to provide us with stability whatever happens in the foreign exchange markets. These include a number of internal measures to more closely balance foreign currency transactions as well as buying future options to cover forecast imbalances.

7. At the time of the acquisition of Contech and Novacom there was optimism about the potential for some large contracts from these new subsidiaries. Is the perceived potential being realised or have these acquisitions been hit by the global downturn?

.

We are very pleased with the progress of both of these areas of our business. Novacom is one of our best performing units and Contech, which focuses particularly on the medical and broadcast sectors, also continues to perform very well: shortly after acquiring Contech we reported a £1million order of infection-resistant keyboards to NHS Connecting for Health; and towards the beginning of the last financial year we announced a significant order for APC Novacom for components designed into sophisticated electronic surveillance and counter measure subsystems.

8. Looking back to the 2008 financial year, APC made a pre-tax profit of £730,000 on turnover of £12.16 million. However, looking at your broker’s forecasts for 2010 and 2011 they are forecasting lower profits than this on a much higher turnover – for 2011 Astaire are forecasting a pre-tax profit of £400,000 on revenue of £14.0 million. Can you explain why their forecast is for a much lower profit than APC achieved 2 years ago? And is there any expectation that matters will improve in future?

.

We are optimistic about our prospects for 2011 but feel it would be foolish to extend expectations with the economy across Europe remaining extremely fragile. As our business develops we would hope to be able to exceed current expectations.

9. Can you say if there has been any progress with entry into the environmental technology sector announced last year?

.

Progress in this area has been very good and early interest has been very encouraging. We have now completed development of the product to the point that it is suitable for international markets, manufacturing has started and we instigated the creation of a new company called minimise (in which APC holds a 19% stake) to handle marketing and sales globally outside North and South America. The product, called the ‘imop’, reduces the energy consumption of electrical motors, helping companies to lower their electricity bills and reduce their carbon footprints. It is becoming increasingly likely that companies will face financial penalties if they fail to act to reduce their carbon emissions, so we see this sector as a growing market.

The product has been independently verified by the European Union as part of its Environmental Technologies Verification scheme, Tritech ETV. It also qualifies for the Carbon Trust interest-free loans scheme, meaning most small-to-medium sized companies can obtain an unsecured, interest-free loan to purchase the imop, with repayments designed to be covered by utility bill savings.

The product is gaining traction and we are in discussions with several companies over potentially very large orders. As the product has only just being brought to market, it is currently difficult to estimate the impact it may have on revenues and it has not yet been included in our forecasts. There is more information on the imop at http://www.theimop.com (worth a look – Ed.).

10. Which are now the most important business sectors for APC?

.

Currently defence and aerospace account for about 40% of sales and transport around 35%. Other significant sectors include industrial, medical and broadcast.

11. Are you expecting any of these areas to be negatively impacted by reduced government spending?

.

There is of course the potential for defence and medical spending to be hit but our expectation is that growth in the sectors will be extremely limited rather than the markets entering into a sharp decline.

much leaner and

more efficient

headroom not

been utilised

would be foolish to

extend expectations

potentially very

large orders

Copyright © Aimzine Ltd 2010

RETURN TO AIMZINE FRONT PAGE | June 2010

This article is the copyright of Aimzine Ltd. No part of this article should be copied, reproduced, distributed or adapted in any way without our prior consent. |