Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. If you are not already registered to read Aimzine please click here

Those who braved the tube strike last month to attend the Growth Company Investor Show were able to enjoy a particularly interesting presentation given by Gervais Williams of Gartmore entitled ‘The Search for Income’, in which the speaker put forward some strong arguments showing why small cap stocks could out-perform large caps for some years to come.

Gervais Williams is a successful Fund Manager for Gartmore where, amongst other funds, he manages the Gartmore Fledgling Trust and the Gartmore Growth Opportunities Trust.

Readers can view this ‘Search for Income’ presentation by clicking here (opens in a new window). I asked Gervais why he believes that Small Caps are likely to outperform. He explained that the smaller companies have out-performed the larger companies over the long term. Put simply, this is because it is a lot easier, for example, to double a £20 million company than it is to double a £2 billion one. In the presentation (slide 3) is a chart showing a considerable outperformance by smaller cap shares since 1955. However, over the last 20 years the situation there has been a rare underperformance (slide 4).

Gervais went on to note that in recent years we have seen a period of extra-ordinary growth in the financial sector. He includes within this definition of the financial sector Banks, Hedge Funds, CDO’s (what are these? – click here to find out) and some property companies. This area has seen exponential growth and has tended to over-shadow the smaller companies. During this time institutional investors have become disillusioned with smaller companies, lost their patience and switched away into larger companies. Nonetheless, many smaller company businesses have continued to grow and prosper but their shares have seriously under-performed. Hence today we find that many small companies are on extremely low ratings.

Small Cap Re-Rating

So what will trigger the re-rating of small cap shares? Gervais believes that the sharp rises in small cap shares seen earlier this year is just the beginning of a re-rating that will see strong performance here for some years to come. He also believes that the credit bubble has inflated large caps and that dividends will be under pressure for some time to come – particularly in the financial sector. Meanwhile, smaller companies, who have been under-distributing, are now likely to pay out a growing stream of income.

An excellent example of a small company beginning to distribute a dividend is Origin Enterprises (see Slide 9). This agricultural business has recently announced it will start to pay a dividend of around 4% from this year. With this dividend being covered approximately 5 times there is obvious scope to increase these payments further.

In the presentation (Slide 11) is a chart showing two periods of several years each in which there has been rapid real dividend growth. During these two periods smaller companies have outperformed the larger ones for a multi-year period.

Market Prospects

I asked Gervais how he viewed prospects for the markets in general over the longer term. He is not optimistic about the wider market and is expecting the larger companies to be constrained by a shortage of capital for many years to come. In this situation he anticipates that index-tracking funds and ‘closet index trackers’ will perform poorly. In this situation he views ‘Special Situations’ as the best prospect going forward.

Looking at the UK economy, the consumers are going to have a difficult time over the next six months. Until now consumer spending has been buoyed by reducing mortgage interest rates but now job losses and an increase in savings may adversely affect retail businesses. There is also the prospect of increasing taxes to add into the equation.

Gartmore Growth Opportunities Fund

| EPIC: GGOR | Market CAP: £48 million | Discount to NAV: 10% |

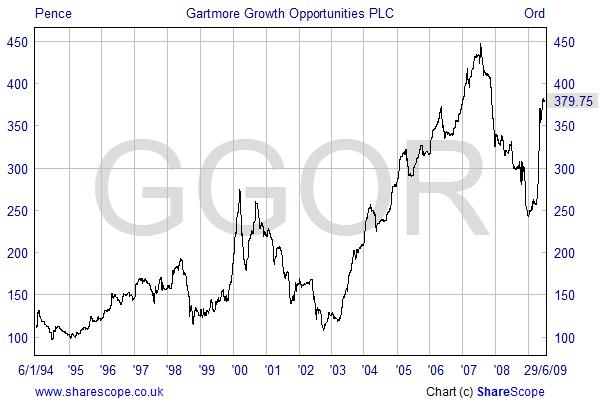

The presentation naturally has a mention of a Gartmore Fund. Slide 13 shows the performance of one of the funds which Gervais manages, The Gartmore Growth Opportunities Trust. We have included (below) a chart which shows the performance of this Investment Trust since 1996, during which time the share price has increased by 210% - even gaining by 14% in the last year.

I asked which sectors this fund will be concentrating on going forward. The fund has been overweight in Oil and Gas, mining and IT Companies and is likely to remain so, although Gervais is keen to point out that most of the companies in which the fund invests are ‘Special Situations’ and as such really belong in a ‘miscellaneous’ sector.

The manager is not restricted to the size of the company he invests in and the fund has investments in some companies with a market cap of under £10 million whilst also have stakes in companies worth over £500 million - more normally they invest the larger part of portfolios at the bottom end of the size band. We noted in the annual report that at 30 June 2008 approximately 10% of the fund’s investments were in Put options on the FTSE 100. These options were sold in October 2008 when, amidst the market panic at that time, good prices were available. A very astute investment!

Whilst the Gartmore Growth Opportunities Trust invests in many AIM Companies it is itself listed on the Main Market. Private Investors can therefore hold these shares in an ISA.

Aimzine Footnote: We speak to several small companies each month and we have also noted that many AIM companies are seriously considering commencing dividend payments – even some very small ones.

Gervais Williams

strong performance

in small cap shares

for years to come

'Special Situations'

- the best prospect

going forward

Written by Michael Crockett

Copyright Aimzine Ltd

RETURN TO AIMZINE NEWSLETTER HOME | July 2009

’

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |