Featured Companies Update

Advertise with AimZine |

Our comments on announcements made during June by companies which we have featured in Aimzine in recent months. To see a list of the companies featured or to view the original Aimzine articles please visit our Archive facility.

Again, there is much to report from our Featured Companies this month. There is particularly promising news from Cinpart, ZOO Digital (see separate article) and Proteome Sciences (another separate article).

Financial spread betting experts specialising in AIM stock trading |

Precision crop nutrition for sustainable agriculture |

Investing in Wellbeing |

Advertise with AimZine

Call Mike Crockett on 07740 655880

Cinpart – ‘Considerable opportunities’

Cinpart announced on 25 June that Active Energy, its 72% owned subsidiary, had signed a Memorandum of Understanding (MOU) with County Executives of America, an organisation which represents County leaders across America. The MOU sets out terms for County Executives to assist Active Energy's development in the USA, including promoting Active Energy both at a senior level in Washington DC, from Congress up to the White House, and to county authorities nationwide.

Active Energy is also considering the development of a US assembly facility. In this respect the RNS stated: ‘Active Energy has already worked with County Executives to identify a suitable location and in accordance with the MOU, County Executives would offer further assistance in setting up a facility, in particular with accessing grants and financial incentives.’

I spoke to Executive Director, Christopher Foster, on the day of the County Executives announcement. Christopher is very optimistic about the future of the VoltageMaster product in the US market. The reduced voltage in the US does not affect the savings that can be made with VoltageMaster. In fact, in the US the savings can often be greater. Furthermore, Christopher believes that the US market is ideal for their product because there is such a strong green emphasis in the country. Over the next 6 to 9 months Active Energy plans to satisfy US orders from the UK. Thereafter, the Company are exploring a number of options to manage the expansion in the US market.

Also on the same day as the County Executives announcement, Cinpart released its final results for the year to 31 December 2009. The results showed a loss for the year of £1.1 million, in line with expectations.

Christopher told Aimzine that the new year has started strongly, partly due to their strategic relationship with SEC in the UK. This relationship is a great help in getting the Company in front of important decision makers and Active Energy are in discussions with some very large companies.

Cinpart estimates the UK commercial market for voltage optimisation products at a staggering £12 billion. Active Energy has 2 competitors in this market and at current production rates the three companies would take 400 years to satisfy the market. Accordingly, it would seem likely that this market will see rapid expansion, particularly as the new Carbon Reduction legislation takes effect.

VoltageMaster

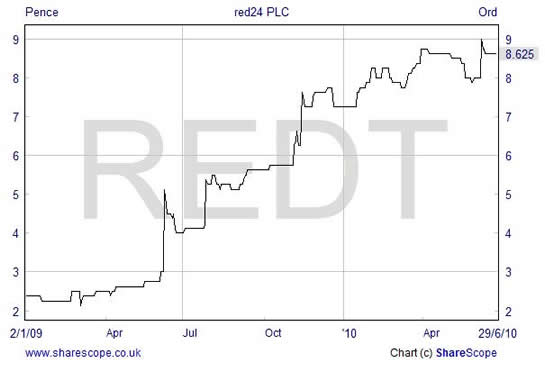

red24

This security specialist issued a strong set of results on 11 June. These final results for the year to 31 March 2010 showed that revenue had grown by 29% to £4,288,000 and that pre-tax profit had increased by 17% to £628,000. Simon Richards, Chairman, commented: ‘This has been an excellent year for the Group and one that saw us build on the sound platform created in the previous year. The strength of our performance was across the board, with revenues, profits and cash generation all showing marked improvements on the prior year and providing us with the confidence to pay our first dividend.’

House broker, Seymour Pierce, estimates that profits will continue to grow in the current year to £790,000 and that earnings per share will reach 1.27 pence. This puts red24 (trading at 8.6 pence at the time of writing) on a forward p/e of just under seven. This seems particularly low especially as the Group has net cash of just under £1 million. The Chairman in his Outlook for the Group made reference to the low share price:

‘Clearly, there are risks to any business and these are considered in the Directors' Report. Nonetheless, the Board feel encouraged by the progress of the last year and are confident of further progress to come. We would hope that in time the share price will reflect the improved outlook for earnings and also the quality of those earnings when compared to others in the sector.’

At least things have improved over the last year. When we published our first report on red24 in May 2009 the share price was just 2.62 pence.

Datong

Another security group to announce improving results was Datong. The Group issued its Interim results to 31 March 2010 on 15 June. Datong is in the process of moving its year end to 30 September, but comparing the results for the 6 months to 31 March 2010 with the equivalent period in the previous year, a considerable improvement can be seen:

£’000’s |

6 months to 31/3/2010 |

6 months to 31/3/2009 |

Revenue |

7,410 |

5,009 |

Profit before exceptionals |

524 |

151 |

Pre-tax profit/(loss) |

206 |

(128) |

The improved figures are due to strong performance in the UK and Europe, whilst revenue from the Americas remained below expectations. In respect of the US business the Chairman commented: ’Whilst we remain cautiously optimistic of further recovery in the US in the short term, the recent order wins and early feedback from key customers regarding our next generation technology platforms underpins our confidence in the longer term outlook for this important territory.’

The Chairman also made some encouraging remarks about short term prospects for the Group overall: ‘Historically the six month period to 30 September has been the quieter operating period with approximately 30% of annual revenues being achieved. However, the Group enters the period this year in a much stronger position than previously seen with a confirmed opening order book of £2.73m (2009: £0.21m) and a robust order pipeline. In addition, new orders received during April and May 2010 totalled £3.66m (2009: £1.06m), all of which is deliverable before 30 September 2010.

There are concerns in this sector that government cutbacks will hit revenues and these concerns are undoubtedly holding back share prices in the sector. However, Datong report that they now see strategies of proactive intelligence gathering as a major thrust of dealing with terrorism, border control, military offence and criminal activity. If this is the case, Datong’s niche business may be isolated from government cutbacks. Certainly the Group is reporting an improving position and expects this improvement to continue.

strong performance in

the UK and Europe

Plant Impact

There were two announcements from Plant Impact (PI) during June. The first, at the beginning of the month, gave details of a new 10 year distribution agreement with Arysta LifeScience for the exclusive marketing of PI’s InCa product in Mexico, Guatemala, Costa Rica, El Salvador, Honduras, Dominican Republic, Panama, Belize and parts of the Caribbean. The first order under this deal is due for shipment in September. The RNS went on say that this Central American distribution agreement is the first of a number of similar deals planned with Arysta.

This is excellent news from Plant Impact. Arysta is a large worldwide player in this market, with sales in 125 countries. They clearly believe that there is a lot of potential in PI’s products. Peter Blezard, CEO of Plant Impact, commented: ‘Plant Impact continues to demonstrate commercial development with key partners like Arysta LifeScience. The relationship between the two companies is strong, with joint teams working on BugOil development, crop nutrient field trial development and commercialisation.’

Later in the month, on 14 June, Plant Impact issued its final results for the year ended 31 March 2010. The results reported strong growth in the year: Turnover in the year was £1,410,711, up from £829,616 in the previous year and the loss for the year was much reduced, down to £1,417,075 from £2,546,326 in 2009. The increase in turnover has come from license agreement milestone payments and direct sales to growers, particularly in the UK and Eastern Europe, and sales via the Group's distributor in the USA.

In his Chairman’s statement, Martin Robinson commented: ‘Our work with growers in recent years has generated increased sales. We continue to work with government agencies and food producers around the world to seek the breakthroughs we need to take the business to another level. This is a long process, in an industry which is slow to change, but we remain confident that we have a range of products which can change the face of agriculture and make a significant contribution to food security and sustainability.’

Media Corp

On 14 June Media Corp reported a strong start to the second half from the Group’s wholly owned online poker and casino business, Purple Lounge. Purple Lounge has seen revenues rising to over £10 million in the first two months of H2; this figure is almost equal to Group revenues for the first half of this financial year. This much improved turnover has been brought about by a number of marketing initiatives taken by Media Corp since the acquisition of Purple Lounge in October 2009.

Media Corp also announced in June that it had raised £0.7 million through the sale of Treasury shares and by some directors exercising warrants. The shares acquired by the directors were subsequently sold just before the emergency budget ‘in anticipation of potential changes to the capital gains tax regime to be announced in the budget’.

revenues over £10 million

in the first two months

Sea Energy

We were most disappointed to learn that SeaEnergy plans to dispose of all, or a significant part of, its SeaEnergy Renewables Limited (SERL) subsidiary. This news was given in SeaEnergy’s final results for 2009 which were released on 18 June 2010. Chairman, Steve Remp, blamed the tough financing environment for this decision. The Chairman commented further:

‘We believe this makes SERL an attractive proposition for prospective buyers and we have already seen interest from a number of third parties over the past year.The sale of SERL would allow us to focus on the development of our Marine Services business which has the ability to generate earnings and cash-flow quickly. SeaEnergy is committed to ensuring that the Company is well-positioned to benefit from the increasing opportunities that the offshore wind industry will continue to provide.’

In May SeaEnergy’s partner in the Inch Cape Offshore Wind Farm Development, RWE npower renewables, had notified SERL and The Crown Estate of its desire to exit the Inch Cape project. The reason given was the considerable size of its other onshore and offshore renewable generation commitments.

To a large extent SeaEnergy’s decision (and that of RWE) is likely to be due to the current shortage of financing. Their results showed a loss for the year of £6.5 million and a year end cash position of £2.8 million, clearly indicating the need for substantial financing.

SeaEnergy also reported in its results that the Mesopotamia Petroleum Company (MPC), in which they hold a 32.67 share, continues to seek the funding needed to progress its Iraqi Joint Venture. Steve Remp commented: ‘Many of our long term shareholders remain intensely focussed on the outcome of MPC and I am very sympathetic to the roller-coaster ride we have all experienced in trying to secure MPC's place in the history books. To them I say, rest assured that I and the MPC team will continue to do our utmost to carve out a position for the company in Iraq but it remains deeply challenging.’

SeaEnergy is experiencing the difficulties of progressing high risk opportunities at a time when funding is very limited. Its share price has reacted to this news by falling from 34 to19 pence (market cap £13 million). The price now seems quite cheap considering the potential value of the SERL assets in particular. However, the shortage of capital which has forced this sale will also have a negative impact on the price attainable for these assets.

Aimzine’s main interest in SeaEnergy has been the SERL assets, which seemed to offer considerable growth opportunities. Now that these assets are to be disposed of, we will no longer cover the Company on a regular basis. We wish Mr Remp and his team well with the Marine Services business and with the Oil & Gas assets and look forward to featuring a revamped SeaEnergy in the not too distant future.

Synchronica

Synchronica released final results for the year to 31 December 2009 on 8 June. The results showed that revenues had increased slightly to £3.83 million whilst the loss before tax had been halved to £3.22 million. At the year end, cash was £2.63 million and there has been a subsequent placing to raise £2.79 million.

On current trading the Company commented: ‘Thanks to the Company's reseller network and the MessagePhone™, 2010 has started positively building the sales pipeline to a higher level than ever before. However to date the conversion of this pipeline to revenue has been slower than expected. The Directors believe that the sales pipeline is sufficient to meet market expectations for the year, provided there is an accelerated rate of conversion to revenue in the remainder of the year. The slower conversion of the sales pipeline has lead to a lower than expected level of cash generation, however the directors believe that the company has sufficient funds to meet its present requirements.’

The comments about the slower revenue conversion coming shortly after problems with delayed orders earlier this year does not help investor confidence. Equity Development (ED) issued a report on Synchronica shortly after the final results were released. ED states that they were leaving their forecasts unchanged at present to see if major contracts currently under discussion fall into place. ED’s forecasts are that revenue will increase by 233% to £12.76 million resulting in a profit in excess of £3million.

Synchronica’s business is expanding rapidly despite its contract problems. Indeed, if expectations had been more modest, the prospects would seem to be very good. Instead, the Company has had to warn on expectations twice in close order. We look forward to reporting further on progress as this year progresses.

Synchronica Stop Press: a deal with an emerging markets device manufacturer was announced on 29 June. The Company commented that the deal will generate $1.28 million of revenue to Synchronica in H1 2010.

In Brief

We were encouraged to note that two directors of Symphony Environmental purchased shares during June. Finance Director, Ian Bristow, picked up 93,947 at 10.578 pence whilst Commercial Director, Michael Stephen, paid 10.625 pence per share for 100,000 shares. When Aimzine first covered Symphony in January 2009 the shares were just 2.6 pence and it is a positve sign that these directors still believe there is good value here at these higher levels.

There was more positive news again in June from mobile data solutions provider, Crimson Tide, which announced a significant new distribution agreement with Avenir Telecom. Barrie Whipp, Executive Chairman of Crimson Tide commented ‘Our partnership with Avenir not only expands our distribution capabilities significantly, it adds the prestige of dealing via one of the industry's most respected organisations. I am sure our partnership will be of significant benefit to Crimson Tide, Avenir Telecom and their partner base.’

Forbidden Technologies announced a new partnership with EditShare on 28 June. The following day the Company issued an upbeat AGM statement which included this comment about potential new partnerships: ‘Consistent with our strategy of partnership development we are at an advanced stage of discussion with a number of large international systems integrators. In each case FORscene would be integrated into a much larger system being marketed internationally.’

Private & Commercial Finance Group issued their final results just as we were going to press. On first reading the results seem to show the Group is weathering the downturn well but remains constrained by the shortage of capital. The Chairman included this comment on the subject: ‘Nonetheless, there is no doubt that the lack of additional funding is preventing us taking advantage of the many opportunities which currently exist to grow our balance sheet and benefit from the highly favourable effects of operational gearing and we are making every effort to find alternative sources of funds.’

Written by Michael Crockett, Aimzine

Copyright © Aimzine Ltd 2010

|

||