Featured Companies Update

Advertise with AimZine |

Our comments on announcements made during July by companies which we have featured in Aimzine in recent months. To see a list of the companies featured or to view the original Aimzine articles please visit our Archive facility.

It may be the summer holiday season but there has still been good newsflow from AimZine's featured companies.

Financial spread betting experts specialising in AIM stock trading |

Precision crop nutrition for sustainable agriculture |

Investing in Wellbeing |

Advertise with AimZine

Call Mike Crockett on 07740 655880

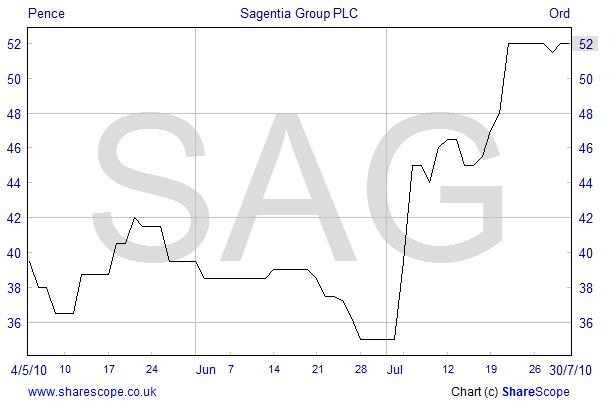

Sagentia Group

Sagentia’s shares climbed 48% during July, buoyed by very positive interim results. Profit before tax was reported at £0.9 million, which was a tremendous performance given that the six month profit figure was greater than market expectations for the whole year.

Part of Sagentia's Head Office

The Group made the following comments about the outlook: ‘As a project-based consultancy, forward visibility is typically limited. However, Sagentia benefits from geographical diversity, with particularly strong demand currently being seen in the North American medical market. As a result, while the Board remains cautious, particularly with a number of large projects coming to completion in the coming months and the number of billable days in the second half reducing due to the summer and Christmas vacation periods, recent new project wins and a good pipeline provide Sagentia with the opportunity to continue the progress made in the first half of the year.’

Whilst there are uncertainties in the outlook, Sagentia’s shares remain cheap even after the recent rise. In the interim accounts the Group’s Net Assets, consisting mainly of property and cash, are valued at £21.38 million. This compares to a market cap of £21.7 million (at the 30 July share price of 52 pence), which implies that very little value is attributed to the existing business, even though it has just reported exceptionally strong results.

Finally on Sagentia, we should commend the Group for getting out its results in quick time. The results for the six months to 30 June 2010 were issued on 21 July – just 3 weeks after the period end.

Omega Diagnostics

Omega issued its results for the year to 31 March 2010 on 16 July. The AIM-listed medical diagnostics company described the results as showing ‘another year of solid progress’. This view is supported by the ‘numbers’ which show turnover up 14% at £6.2 million and profit before tax up 9% at £0.59 million. Omega’s ‘Food Detective’ food intolerance tests performed particularly strongly and the product is now being sold in over forty countries.

Both the Chairman and the Chief Executive made interesting comments about the outlook for Omega. The Chairman, David Evans, reported: ‘We continue to review acquisition opportunities to transform the Group and whilst there can be no guarantee of completing any transaction, I hope to be able to update you with progress on this element of our strategy during this financial year.’

Chief Executive, Andrew Shepherd’s Outlook statement dealt with prospects for the existing businesses:‘The outlook for the new financial year is encouraging and we continue to review promising opportunities, both organic and acquisitive. The market for the Group's products continues to expand despite local difficulties in some eurozone countries. The major growth in the world IVD market, in particular, in countries such as India, China and Brazil, should compensate for any reduction in sales in problematic markets, which is one of the key strengths of the Group's global distribution network.’ Clearly there is an advantage in investing in companies with exposure to the stronger world economies.

Eredene Capital

Eredene Capital also benefits from a strong economy. This AIM-quoted investor in Indian Infrastructure reported, in its recent final results, an uplift in the value of its investments in India by 35%. The results for the year to 31 March 2010 reported a Net Asset Value of 23.0 pence per share, which compares to a share price of 20 pence (30 July).

Eredene has invested in eleven projects in India of which nine are in ports/port services, logistics and distribution warehouses. At the beginning of July the Group announced that it made a significant investment in Ocean Sparkle, India's leading port operations and marine services company (www.oceansparkle.com). This privately owned Hyderabad-based company, which was founded in 1995, generated revenue of £26.4m and net profits of £5.2m in the year ended 31 March 2009.

Ocean Sparkle owns and manages a fleet of 82 vessels, comprising 59 tugs, 5 dredgers, 5 barges, 5 mooring boats and 8 pilot launches. It services 18 ports across India and also has three joint ventures in India with the Port of Singapore Authority and a subsidiary operation in Oman. It is the market leader in the Indian port operations and marine services industry, and provides the full range of support to incoming and departing ships, such as pilotage, anchoring and berthing, and also undertakes dredging contracts.

Aimzine Comment: Eredene is investing in a buoyant economy. This is clearly shown by these remarks from Chairman David Coltman’s results statement: ‘India's economy bucked the international recession and grew at 7.4% in the year ended 31 March 2010, one of the highest growth rates in the world. The Indian economy is forecast to grow by 8.5% in 2010-11, and the pro-business Government of Prime Minister Manmohan Singh is pursuing an annual growth target rate of 9% for the period from 2012 to 2017.’ That Eredene trades today at a discount to Net Asset Value is probably a reflection of the UK view of the world economy.

InterQuest

The Trading Statement issued by IT staffing specialist, InterQuest Group, on 16 July reported that net fee income in the first half of the current year was 14% higher than in the first half of 2009. Gary Ashworth, Executive Chairman of InterQuest Group plc, commented:

‘Trading in the first six months of the year has been strong, showing increased levels of demand in both permanent and contract recruitment. While there has been some weakness in the public sector, this has been more than offset by growth in the private sector.’

There has also been a number of director share trades reported in the last month. The most significant trades were by Gary Ashworth and Luke Johnson (non-executive director) who sold 900,000 and 775,000 shares respectively for 55 pence per share. These are significant blocks of shares which were sold due to ‘institutional demand’. Indeed the evidence for this demand was given in a ‘Holding in Company’ announcement subsequently which reported that Axa had purchased 1,300,000 InterQuest shares.

Whilst it is always a worry to see directors selling shares, both of these directors retain substantial holding in the Group. Indeed Gary Ashworth has subsequently added to his share holding by exercising 250,000 warrants at 25 pence. Furthermore, non-executive director, Paul Frew, showed his confidence in the business by picking up 20,000 shares at 55 pence at the beginning of July.

Gary Ashworth

Synchronica

July was another busy month for Synchronica. As well as the ‘usual’ contract RNSs there was news of a proposed acquisition and the company issued its interim results.

The interim results to 30 June 2010, which were issued just 2 weeks after the period end, on 15 July, reported that revenues were up 2.5 times at £3.43 million and that the loss before tax had been reduced to £1.34 million from £2.49 million in 2009.

Carsten Brinkschulte, CEO of Synchronica, reported: ‘We have made significant progress over the past six months and expect to continue this accelerated momentum in the second half of the year. Not only are we signing up more customers, we are also seeing an increase in the average deal size. With a sustained commitment to innovative product development, in tandem with our global international reseller network of system integrators and device manufacturers, Synchronica is on its way to become the market leader for next-generation mobile messaging services in emerging markets.’

On 20 July Synchronica announced a proposed takeover of Canadian mobile software company, iseemedia in an all share deal valued at approximately £5.3 million. Iseemedia is listed on the Canadian TSX Venture exchange and Synchronica will be applying for a listing on this exchange. Synchronica’s AIM listing will be retained.

In the acquisition RNS Carsten Brinkschulte, CEO of Synchronica, stated: ‘The proposed acquisition of iseemedia further demonstrates our commitment to shape the future of mobile messaging in emerging markets and is a key step towards a market-leading position for Synchronica in this fast-growing segment. Delivering an enhanced user experience for next-generation mobile messaging on any handset is core to our mission. The proposed transaction perfectly complements our existing competencies, specifically iseemedia's patent-pending document transcoding technology, and the additional contracts with large mobile operators in India, which will accelerate our transition to a sustainable, recurring revenue profile.’

Cinpart

There was news this month of another contract for Cinpart. The contract, for £375,000, is to supply VoltageMaster units to five prisons across the UK. The Company reported that it was encouraged that the contract had been won under the framework agreement announced in September 2009 with members of the Eastern Shires Purchasing Organisation - a local authority purchasing consortium, which Government departments are able to use to simplify their purchasing process.

Also in July, Cinpart announced a placing, at 7 pence per share, to raise £1.32 million after expenses. The proceeds of the placing will be used to support the company's sales and marketing efforts in the UK and to provide working capital generally in order to build on the progress made to date. Three of Cinpart’s directors purchased shares in the placing.

Cinpart will change its name to Active Energy Group (AEG) on Monday, 2 August. Also on this day shareholders will receive 1 ‘bonus’ share for each 20 shares they hold in the Group.

Cinpart becomes Active Energy Group (AEG)

from 2nd August

Surgical Innovations

Medical devices Group, Surgical Innovations (SI), announced on 28 July that it has been granted clearance from the US Food and Drug Administration for its Logi®Flex device. The clearance permits the use of Logi®Flex in the US market for both gastric band deployment and other associated bariatric (weight reduction) procedures. In our June article on Surgical Innovations we highlighted the importance of US market to SI and this clearance is most encouraging.

Graham Bowland, Chief Executive Officer of the Group made the following comments in the announcement: ‘We are delighted to be able to announce this approval which will see the pioneering device now being sold into the US. The majority of surgical instruments in the US are single use; however with growing financial constraints being placed on hospital budgets, procurement managers are continuously looking for cost effective instrumentation and Logi®Flex offers the ideal high quality, cost effective solution.’

clearance from the FDA

ZOO Digital

ZOO announced on 26 July that it had launched an automated style-guide production system for home entertainment products and had secured Warner Home Video International as its first customer. We are pleased to see that ZOO have been able to name this significant customer.

Stuart Green, CEO of ZOO commented: ‘In the past, style-guides - those all important standard, style and format-setting documents for product packaging and marketing campaigns - have been created manually. Now with our new automated system, these documents can be produced more quickly and easily, saving time and cost and providing greater centralised control.’

Earlier in the month, on 6 July, ZOO announced that non-executive chairman, Roger Jeynes, had purchased 20,000 shares at 40.5 pence from ZOO’s Employee Share Trust. This was the Chairman’s first purchase of shares in the Group.

Forbidden Technologies

During July Forbidden announced on two separate occasions that the T1ps Smaller Companies Growth Fund had exercised options at 12 pence per share. In total the fund subscribed for 1,255,000 shares in July.

Also, we were encouraged to see the Company report that two of its directors had purchased shares. On 28 July Forbidden reported that Executive Chairman, Vic Steel, purchased 450,000 shares at 16 pence and that Financial Director, Phil Madden, purchased 75,000 shares, also at 16 pence.

Warner Home Video as

its first style-guide customer

Mediwatch

This urological diagnostic group issued its half year results on 28 July, which showed that revenues remained almost the same as in 2009 at £4,959,000. Meanwhile, profits increased to £130,000 from £37,000. The group reported that revenues remained steady due to the ‘economic climate’. However, Mediwatch is optimistic in the longer term: ‘the market outlook is very positive as a result of the aging population and the increasing need for healthcare products and services’.

There was no news in the results of the long running FDA approval process for PSAwatch except that ‘progress continues to be made’ with the approval and the Group ‘continues to engage the services of a specialist group to expedite this process’. On a positive note, Mediwatch has a number of interesting new developments which are expected to contribute to revenues later this year and in future years.

In Brief

Synairgen announced its Final results for the year to 30 June 2010 on 29 July. The company reported a loss of £2.6 million, well below their house broker’s forecast loss of £4.3 million. Cash at 30 June 2010 was £5.0 million. Commenting on the results, Simon Shaw, Chairman of Synairgen, said: ‘I am delighted that we have added influenza as a new third indication for inhaled interferon beta and commenced the Phase II study in asthma. During the forthcoming year, our focus will be on progressing the asthma, influenza and COPD programmes. These activities, together with the process being conducted on our behalf by Deloitte LLP's licensing team, will support the effective execution of our partnering strategy.’

Aimzine commented on Synairgen’s exciting ‘positive influenza data’ in the AIM Snippet article in June 2010.

Proteome Sciences announced on 6 July that three of its directors had purchased shares in the recent placing and open offer. The purchases at 20 pence per share were: James Malthouse (Finance Director) 130,031 shares, Stephen Harris (Non-executive Chairman) 24,199 shares and William Dawson (Non-executive Director) 5,248 shares.

In a trading statement issued on 13 July, Plethora Solutions announced that its Interim Results, due to be published in September, will report revenues of £1.0 million in line with expectations. In the announcement Bill Robinson, Non-Executive Chairman, stated: ‘Our interim results will show that the Company is meeting the objectives we outlined in December 2009. The Urology Company has now assembled its initial portfolio of products and undertaken its first product launches. The focus for the remainder of the year will be to generate sales through the marketing subsidiary to add to the embedded value arising from PSD502 and PSD503, which are in the hands of partners.’ Plethora also announced in July a new male sexual health product to add to its Urology Company’s portfolio.

Video search engine specialist, Blinkx, reported on 15 July that Samsung had selected it for participation in SamsungApps. Under the terms of the agreement, blinkx’s video application, ‘Beat’, will be promoted on Samsung"s new Galaxy S handset. In typical style, blinkx described ‘Beat’ as: ‘a never-ending playlist of the most popular videos from the around Web-hilarious bloopers, amazing stunts, ridiculous pranks and cute animals-a riveting channel of snackable video delivered straight to your smartphone’.

Daniel Stewart was forced to issue an RNS on 22 July to deny a comment in the FT Market Report that it was trying to raise cash through an equity issue. The Company pointed out in the announcement that it had already raised significant funds in recent months

Written by Michael Crockett, Aimzine

Copyright © Aimzine Ltd 2010

|

||