Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. If you are not already registered to read Aimzine please click here

With the wide diversity of AIM Companies, there are always some companies performing well, no matter how badly the economy is performing. This is certainly true in the current recession, where many AIM Companies are experiencing particularly strong trading. This may be because of the sector that they operate in or simply because they have a particularly successful formula.

In this article we have invited contributions from four AIM Companies and asked them to explain why they are performing particularly well. All of the companies we cover here anticipate that their growth will continue despite the recession.

The four companies that we feature are:

Click on the links above to navigate directly to a company’s section.

Of course the big question for investors is whether the share price fully reflects the growth potential and we can only leave this to readers to judge. Given the optimism expressed here, these companies are worthy of further investigation. We will report back in the New Year to see how the shares of these four Growth companies are performing.

Given the optimism expressed here these companies are worthy of further investigation |

Code: ALL Share Price 60 pence Market Cap: £27 Million

Technology stocks have, like the rest of the market been through a rough ride, but those with a strong balance sheet and cash in the bank, delivering year on year growth, are well placed as the market slowly appears to be gathering momentum. Allocate Software plc, which provides workforce optimisation software applications for world-wide organisations with large, multi-skilled workforces, has continued to build its presence and delivered 36% growth in the past year.

Allocate operates in 4 key vertical markets: Defence, Healthcare, Maritime and more recently Government & Education. In particular, Allocate has continued to strengthen its position in the Healthcare market, increasing the client base to over 185 NHS Trusts and four private healthcare providers through the adoption of its MAPS Health Suite solution, which includes a further 13 contract wins in the first quarter.

For all companies looking at capital expenditure, a key priority is ROI, demonstrated by County Durham and Darlington’s NHS Foundation Trust, which accredited a £1.2 million saving on its staff and agency costs to Allocate’s MAPS Healthroster software.

Current clients in the defence sector include NATO, HQ Land Forces and the Royal Australian Navy, while maritime clients include Acergy, Maersk Oil Qatar and the World’s leading family entertainment company. Acergy sought a solution for both onshore and offshore operational units, and following extensive evaluation, selected MAPS Maritime Suite as a result of its proven expertise and implementation experience in large, complex global organisations and its delivery of a stable, well-tested solution and functionalities.

In the year to May 2009, Allocate delivered 36% EPS growth, 24% organic revenue growth and outperformed Numis’ already upgraded forecasts, and continued to deliver a raft of new contracts in its first quarter.

“Our corporate objective is to have organic growth every year for the next three years of between 15 & 30%,” commented Chief Executive Officer Ian Bowles, “ Numis currently forecast our growth for FY10 at 10%, a number I am confident we will achieve, if not exceed.”

Allocate, which has corporate headquarters in London, and offices in the USA, Australia and Malaysia, has a strong sales pipeline and continues to look at further complementary businesses as part of its growth strategy.

Allocate Software Investor Relations web page

Code: NXS Share Price 1 pence Market Cap: £9.4 Million

Thanks to its diversified portfolio of businesses and associated services, Nexus Management, the provider of specialist IT Managed Services, has enjoyed growth, despite difficult times, and expects to see this trend continue into the future.

Profitable growth is extremely difficult during a recession when prices are being squeezed by savvy buyers. It is often the case that larger orders get delayed in a recession until financial stability improves. Nexus’ core business, however, relies on sustained volumes of smaller recurring contracts which generally remain stable in a downturn, with some cancellations or new business wins showing small fluctuations.

Nexus has, through acquisition, also grown in size recently and is very well positioned to grow more quickly once the recession is over. The Resilience division has a large number of maintenance contracts that are very stable and although larger orders to new customers are susceptible to delay this part of the Group is not totally dependent on this type of business.

While UK operations have suffered the effects of the recession with fewer opportunities to grow here in London, Nexus’ US operations have been less affected.

Roger Richardson, CEO explains: “Having diverse businesses in multiple countries has helped mitigate the Group’s overall exposure to the economic downturn. The North East coast of the US seems to have weathered the storm a little better than London and New York.”

Nexus acquired Nerd Force Inc, a fast growing mobile computer and technology provider in June 2008 with the explicit intention of expanding the franchise’s business model. Since then, Nerd Force has become one of the fastest growing IT franchises of its kind, having sold in excess of 180 territories (27 of which are currently active) throughout Europe and the US.

A Nerd Force franchise gives IT professionals who have been made redundant the opportunity to use their skills and start their own business; they also receive on-going support from Nexus Management to grow the business.

Nexus recently appointed Les Dyson, of First for Franchising, to market and develop Nerd Force in the UK. Les Dyson has extensive experience advising new franchises and the UK roll-out is imminent.

As all businesses, especially small and medium sized companies, seek more cost efficient solutions to run their operations in the downturn, Nexus’ data centre business is well positioned to reap the benefits of the ongoing cost-cutting exercises – Nexus offers a cheaper hosting facility accompanied by a 24 hour support service.

Unlike many businesses, Nexus took the initiative to overhaul its UK marketing efforts despite the recession, taking these in-house to lower costs and refocus the initial contact with prospective clients. Although late for this fiscal year we expect to see the fruits of this more aggressive approach in the New Year.

Roger Richardson, CEO said: “We anticipated the tough times of the last 9 months by reducing our corporate overhead in January and delaying a number of costs that would have been spent in a better economy. Our core business that underpins Nexus has been able to grow in spite of the economic recession because we have multiple products sold to both consumers and businesses. We operate in numerous countries and have many different channels to market. This gives us a buffer and resilience to a downturn in any one sector or market.”

Nexus Management Investor Relations web page

Code: FBT Share Price 21.5 pence Market Cap: £17 Million

Generals are sometimes accused of fighting the last war, but Forbidden Technologies has been gearing up for the next one since its AIM flotation in February 2000. The definitive TMT stock, Forbidden's objective has been to create the ultimate video platform for the Web. Technological progress has been rapid: in less than ten years, the FORscene video platform leads the world with its combination of accessibility, power and versatility.

Back in 2000, Internet speeds were 1000 times slower than today, giving small, jerky videos. Primitive mobile devices with slow connections had limited functionality and no video capability. Forbidden's FORscene Web video platform required the creation of a whole new technology infrastructure: video compression technology for high performance video editing over the Internet; browser-based video player and editing software; a simple but powerful video editing interface; and distributed low cost servers capable of supporting a large user base.

In fact, no large UK company could grant funds for such a strategic investment in a market which was ten years away from materialising; and no small company could raise the money to develop it. Except, as it happens, Forbidden Technologies.

Ten years on, FORscene does for video editing what Google does for search and Facebook does for social networking. The ability to review, log, edit, publish and host videos through a browser on any PC or Mac is attracting customers in broadcast television. More recently, the requirements of preserving and enhancing brand value on the Web have driven the creation of a whole new growth market – that for professionally made Web video. FORscene's Web front end and broadcast pedigree make it a perfect fit.

With media budgets under considerable financial pressure and escalating demands for new content, FORscene's efficiency savings ensure Forbidden is positioned to take advantage of the current global recession. Despite the credit crunch, Forbidden's turnover grew 71% in 2008 and analysts expect over 100% further growth in 2009.

Efficiency is no longer a luxury for the multi-billion dollar broadcast industry. The Web is a transforming technology whose time has come - and with Web video itself already overtaking traditional television broadcasts in some countries, Forbidden's FORscene video platform is prepared for explosive growth.

Forbidden Technologies Investor Relations web page

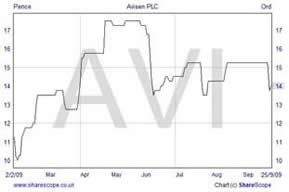

Code: AVI Share Price 14 pence Market Cap: £20 Million

Avisen Plc, a business and technology consultancy specialising in performance management, was acquired by the AIM quoted cash shell, Z Group plc, on 2nd February 2009 in a reverse takeover transaction. The Company’s aggressive growth strategy, with four acquisitions to date, is proving to be a recipe for success.

Marcus Hanke, CEO, stated: “During the recession we have seen a willingness from companies to be acquired due to the stability and access to funding that being part of a plc company provides. We have been able to use our listing to carry out paper transactions and we hope to continue our buy-and-build strategy well into 2010.”

The Company’s latest acquisition, Inca Holdings, has positioned Avisen as the leading IBM Cognos reseller and consultancy provider in the UK. The acquisition was triggered during the recent trend of consolidation within the IBM Cognos reseller market. IBM are working towards standardisation, reducing the number of business partners they have in order to create a very specific and focused partner community. The consolidation of businesses within this sector means that companies’ skill sets are merged and accreditations are easier to achieve as a combined business. “Partners are beginning to recognize the benefits of working together in order to be a stronger partner for IBM - hence the consolidation trend” explains Marcus Hanke.

The acquisition of these types of businesses (e.g. Inca Holdings) brings high levels of recurring revenues for Avisen, along with ongoing customer support contracts, further providing value to the business as a whole. Avisen is mitigating its operational risks by continuing to extend the geographical spread of the business in overseas markets as well as the within UK (they have also previously established a presence in South Africa and the Netherlands). Several long-term engagements, coupled with a supported customer base and revenues generated through ongoing renewals, provide revenue stability to the Company.

“We practice what we preach” said Marcus Hanke. “IBM Cognos is a performance management solution, giving companies visibility and insight into future performance. The solution is used within the business to overcome issues such as lack of visibility. We enable companies to plan and prepare for the ‘what-if’ scenarios that are ever present during uncertain economic environments, but are still necessary during times of stability in order to grow businesses and challenge competitors."

Avisen Investor Relations web page

Author Michael Crockett

Copyright Aimzine Ltd

RETURN TO AIMZINE FRONT PAGE | October 2009

’

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |