Cinpart

A Transformational Acquisition

RETURN TO AIMZINE FRONT PAGE | October 2009

Cinpart’s share price has increased 15 fold during the last 9 months but there could be potential for further considerable gains. The key to the share price performance has been the transformational purchase of the rights to the VoltageMaster voltage optimisation product and the set up of the new Active Energy subsidiary. Whilst it is still early days in the development of this business, there are some strong indications that VoltageMaster and Active Energy will have a very lucrative future.

I met with Executive Director, Christopher Foster, to learn more about the excitement around VoltageMaster. Christopher is very enthusiastic about the product and it would seem with good reason.

Christopher originally became involved with Cinpart (then Buckland Group) in June 2007 at the time it purchased Gasignition Limited. Buckland Group was renamed Cinpart shortly after this. Christopher’s brother, Timothy, is Cinpart’s largest shareholder, holding 13.87% of the issued share capital. To see the full list of significant shareholders please click here.

Timely Acquisition

Active Energy was established in March 2009 and is 72% owned by Cinpart. In the deal at that time the Company purchased the rights to VoltageMaster from SDC Industries, a private company based in East Kilbride. The proprietor of SDC, Stephen Coomes, owns the remaining 28% of Active Energy. Please click here to view the March RNS statement which explains further details of the set up of Active Energy.

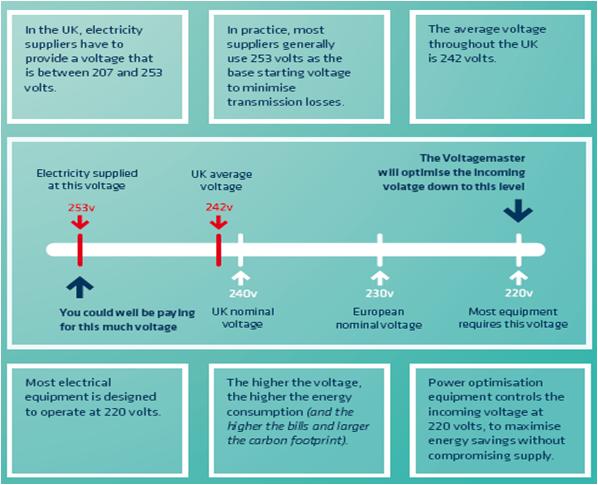

The opportunity for VoltageMaster comes from the way electricity is supplied: power supply companies are required to maintain a minimum voltage throughout the entire distribution system. In the UK this minimum figure is 207 volts. However, because there is natural voltage loss over distance, the voltage at power substations needs to be much higher than this minimum figure – in the UK the reading at substations is 253 volts. Most equipment is designed to run at an optimum 220 volts but the UK average voltage actually supplied is 242 volts – which is where the VoltageMaster equipment comes in. The product will effectively reduce the voltage received by businesses down to 220 volts thus saving money and helping to reduce greenhouse gas emissions. The slide below from a recent Cinpart presentation illustrates VoltageMaster’s power optimisation.

|

Christopher Foster visiting No. 10 for a meeting with

Nick Butler, senior policy advisor to Gordon Brown

The VoltageMaster product is available in a range of sizes to business customers priced between £8,000 and £58,000. Larger customers will require a number of the top of the range products.

The VoltageMaster

Carrots and Sticks

The big attraction of VoltageMaster comes in the savings it can provide. Christopher believes that most customers can recoup the cost of the equipment in as little as one year. In addition there are government ‘carrots and sticks’ which will encourage sales for Active Energy.

Firstly, the carrot: Interest free loans up to £400,000 are available through the Carbon Trust for companies that purchase VoltageMaster. The repayment term of the loan can be matched to the payback period. In effect this enables companies to purchase VoltageMaster equipment at a nil cost.

Secondly, the stick: It is anticipated that from April 2010 that the UK will introduce a new energy saving scheme called the Carbon Reduction Commitment. As part of this scheme, companies which do not reduce their energy consumption are liable to fines.

Given the payback period and the government incentives, the attraction of VoltageMaster to Cinpart is clear. I asked Christopher about the competition from similar products. He explained that he is only aware of two other companies in the world which manufacture such products – one in Japan and one in the UK. He believes that it would be difficult for new players to enter the arena in the short term because of the time it would take to develop the product and gain the appropriate country approvals. This is the process that SDC has completed with VoltageMaster over some years.

A Promising Start

The VoltageMaster product as produced by SDC has already been sold into a number of businesses including hotels, council buildings, retail outlets, leisure facilities and even prisons.

Following the set up of Active Energy in March 2009, Cinpart have announced two significant contracts. The first, announced in June, was with ‘a well known leading international retailer and manufacturer of affordable home products’ and was valued at £1.18 million.

More recently, on 2 September, Cinpart announced that a tender had been accepted under a Framework Agreement to members of the Eastern Shires Purchasing Organisation (ESPO). EPSO is a local authority purchasing consortium operating throughout the Midands and East of England. Under this framework agreement there is no contractual commitment to purchase products, but Active Energy have been advised that the estimated value of the contract is £15 million. Significantly, Kevin Baker (Cinpart’s CEO) commented at the time that this Framework Agreement ‘is the first of many anticipated signings with local authorities’.

It is not only local government that is showing an interest in VoltageMaster. Cinpart has received an invitation to submit a proposal to install voltage optimisers in both the House of Commons and the House of Lords.

At the time of the June contract announcement Cinpart stated that this £1.18 million order would be satisfied in conjunction with SDC industries. Hence, these units will be manufactured in East Kilbride. However, Cinpart also has an established production facility in Thailand and it has plans to manufacture components for VoltageMaster in Thailand.

In the Interim results issued on 17 September 2009, the Company stated that whilst it was experiencing longer lead times for VoltageMaster sales, the number of sales leads had increased at a faster rate than had originally been anticipated. In reaction to this, Active Energy has recently doubled the size of its sales team. The Company raised £730,000 after expenses in a placing at 10 pence per share in July. Some of these additional funds are being used to fund this expansion of the sales team.

customers can recoup

the cost of the equipment

in as little as one year

Cinpart at a glance |

+ Considerable potential for Active Energy |

+ Tax incentives for buyers of VoltageMaster |

+ New Contract Tender could be worth £15 m |

+ Only limited competition for VoltageMaster |

- Gasignition business currently loss making |

-VoltageMaster complex sales process |

- 2009 results below expectations |

- Shares have already increased 14-fold in last 9 months |

Results and Forecasts

In this article I have concentrated on Cinpart’s 72%-owned Active Energy subsidiary because this will become the major part of the business. The company also has two other active subsidiaries in Gasignition and Derlite. As its name implies, Gasignition markets the spark modules that are found in many gas appliances. Indeed, the company supplies 75% of the UK market for this product. Derlite manufactures products for Gasignition and is located in Thailand.

Gasignition/Derlite have been impacted by the recession In particular suppliers have been reducing their stock levels. However, trading has recently improved and the Company are anticipating a return to profitability for these companies in the future. The poor performance by these divisions impacted Cinpart’s recent Interim results which showed a loss before tax of £705,000 compared to a loss of just £180,000 in the previous year. Almost half of this loss is accounted for by exceptional charges including £151,000 in relation to costs for the set up of Active Energy. No revenue was booked for Active Energy in the first half of the year.

|

Year to 31/12/08 |

6 Months to 30/6/09 |

Year to 31/12/09 (Forecast)** |

Year to 31/12/10 (Forecast)** |

Year to 31/12/11 (Forecast)** |

Turnover (£m) |

2.03 |

0.80 |

4.1 |

6.3 |

20.0 |

Pre-tax Profit (£m) |

(0.28) |

(0.70) |

0.1 |

1.0 |

4.1 |

Earnings per share - pence |

(1.09) |

(1.17) |

0.15 |

1.15 |

4.20 |

**The table above includes the recent interim results and forecasts produced by Growth Equities & Company Research in April 2009. The Company stated in its recent Interim statement that results for the year to 31 December 2009 would be lower than these market expectations due to the delays caused by the extended sales process. The Company did, however, say that they are expecting to return to operating profitability in the second half of 2009 and that they remain confident about the prospects for 2010 and beyond. We understand that a new broker’s note is due to be released in the near future and we will update readers with details of new forecasts in our ‘Featured Companies Update’ column in a subsequent edition of Aimzine.

sales leads increased

faster than originally

anticipated

they remain confident

about prospects for

2010 and beyond

Investment Considerations

Cinpart’s shares reached a low of 1 penny in December 2008 and have subsequently climbed to 15 pence.

The strength of the share so far this year does mean that there is a danger that the shares could be hit by a bout of profit taking at some point. However, if the business continues as forecast then this would only be a short term problem.

Christopher Foster is certainly very enthusiastic about the prospects for VoltageMaster and seemingly with very good reason. This product can provide customers with a very quick payback and they can buy it with the help of an interest free loan – AND, from next year, by doing so they will avoid being fined. Furthermore, it would seem that there is limited competition in the marketplace for VoltageMaster at present and there are some barriers to entry for competitors. Active Energy should therefore have a very receptive marketplace, at least in the short term.

Exactly how big this business (and also the share price) will become is very difficult to judge at this stage. Could it really be possible this small AIM Company will grab a very large share of what could be a huge market worldwide? It is quite possible, but development of the business is still at an early stage and there are no guarantees. For example, there are other products that can produce energy savings for businesses and these may gain greater acceptance in the market than VoltageMaster.

Nonetheless, we find this a very exciting company and we look forward to tracking progress at Cinpart over the coming months.

it would seem there is

limited competition

in the marketplace

Written by Michael Crockett, Aimzine

Copyright © Aimzine Ltd 2009

RETURN TO AIMZINE FRONT PAGE | October 2009

Discuss this article

|

||