Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. If you are not already registered to read Aimzine please click here

In the December edition of Aimzine we looked at the Pensions Problem created by the move away from Final Salary pension schemes. We reported that: whilst the cost of pension provision for many employers has fallen sharply, their employees are now saving much less for their pensions than they were a few years ago. To make matters worse, low investment returns and improving longevity mean that each £1 of pension is costs more to buy.

We believe that there are millions of people whose pension provision is woefully inadequate. This will ultimately mean that people will either have to work longer to build up a larger pension pot or be prepared to accept a much lower standard of living in retirement.

However, for those who are willing to save some additional funds to supplement their pension there is the opportunity to contribute to a SIPP (Self Invested Personal Pension). Although these tax-efficient vehicles have been around for 21 years, many people are still unaware of them. Yet, almost all UK residents under the age of 75 are eligible for a SIPP.

It is not within the scope of this article to go into a lengthy explanation of SIPP’s. Many brokers provide information on the subject. Hargreaves Lansdown, for example, has a well presented SIPP section on their website.

The great advantage of a SIPP is that it provides control and flexibility. You can invest in a wide range of assets including shares, gilts, bonds and property. Our particular interest is that you can invest directly in AIM shares within a SIPP.

It is easy to set up a SIPP suitable for holding UK-listed shares. Most retail brokers provide such a facility where shares are held in a SIPP nominee account. The same account can also hold Investment Trust shares, Unit Trusts, OIECS as well as gilts and bonds. Charges for SIPP accounts vary widely and it may be wise looking carefully at a number of brokers and comparing all charges. In this context this Money Saving Expert link may be helpful.

control and flexibility

Not a Gamble

On a personal note, I opened a SIPP account back in 2001. My SIPP has been invested primarily in AIM-listed companies over the last 9 years. When I mention to friends that a substantial part of my pension pot is invested in AIM shares and suggest that they might consider a similar path, their reaction is usually one of horror. To many, investing in small cap shares is viewed in the same league as investing in a horse in the 2:30 at Kempton. (Incidentally, gambling is not allowed in SIPP’s – even if it is a ‘cert’!).

There is strong evidence, however, that small cap shares out-perform larger ones over the long term (see our July article, ‘The Search for Income’). This evidence is something that the fund management industry does not publicise too widely - perhaps because most of their industry is set up to invest in larger companies.

small cap shares

out-perform larger ones

The Fund Option

For those who do not have the time and inclination to invest directly in small company shares, there are a number of successful funds that invest primarily in small cap shares. I will mention two examples; both of these funds can be help within a Sipp.

The SF T1ps Smaller Companies Growth Fund was launched in November 2007 and has shown good growth in its first two years. At the time of writing this unit trust has grown by 40% in its short history.

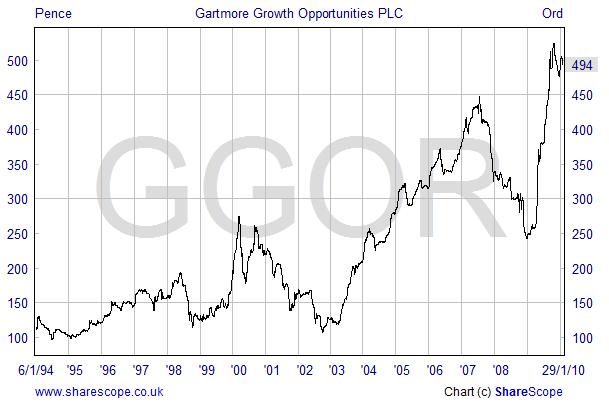

A more established smaller companies fund is the Gartmore Growth Opportunities Investment Trust. This fund was set up in 1991 and has performed extremely well since that date. Our chart below shows the growth in the fund since 1994:

The Shares Option

The big disadvantage for an investment trust or unit trust is that they have large sums of money to invest. This can be a disadvantage when dealing in small company shares. An experienced private investor can often out-perform large funds. To support this assertion I will turn to one of the world’s most successful investors.

Warren Buffett was once quoted as saying that with a small sum to manage that he could compound his fund by an annual rate of 50% or more. Warren went on to say:

I could name half a dozen people that I think can compound $1 million at 50% per year -- at least they'd have that return expectation -- if they needed it. They'd have to give that $1 million their full attention. But they couldn't compound $100 million or $1 billion at anything remotely like that rate.

There are little tiny areas, as I said, in that Adam Smith interview a few years ago, where if you start with A and you go through and look at everything -- and look for small securities in your area of competence where you can understand the business and occasionally find little arbitrage situations or little wrinkles here and there in the market -- I think working with a very small sum, there is an opportunity to earn very high returns.

Most people will not have the time available nor the experience of a Warren Buffett, but his assertion does suggest that it is worth considering investing directly in small company shares. Exceptional growth over an extended period would be very helpful in building up a pension pot over time. The fifty percent growth that Mr Buffett suggests may not be achievable by most, but even a 10% annualised growth would mean that funds would double every 7 years. That is pretty useful if you are building up a pension fund!

I will conclude on a note of caution. The figures quoted by Warren Buffet are for investors with a proven track record. Investors should not even think about investing parts of their pension fund in shares until they can clearly demonstrate a successful investment track record in a variety of market conditions. One way to develop a proven investment track record might be to read a book about Warren Buffet’s investment philosophy – such as The Buffettology Workbook.

an annual rate of

50% or more

funds would double

every 7 years

Written by Michael Crockett

Copyright Aimzine Ltd

RETURN TO AIMZINE FRONT PAGE | February 2010

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |