Featured Companies Update

RETURN TO AIMZINE FRONT PAGE | June 2010

Advertise with AimZine |

Our comments on announcements made during May by companies which we have featured in Aimzine in recent months. To see a list of the companies featured or to view the original Aimzine articles please visit our Archive facility.

In addition to the updates below there is an important update on Synairgen covered in this month’s AIM Snippet article. Also, there is a separate Q & A article on Advanced Power Components.

Financial spread betting experts specialising in AIM stock trading |

Precision crop nutrition for sustainable agriculture |

Investing in Wellbeing |

Advertise with AimZine

Call Mike Crockett on 07740 655880

Whilst May has been a very difficult month for the markets, some of the shares we monitor have had a very good month. For example blinkx has seen its shares up by over 100% during May and Advanced Power Components has gained 145%.

Media Corp – ‘Confident of an excellent outcome’

Another share to show strong gains in May was Media Corp. This Group issued an excellent set of Interim results on 26 May. These were the first results to include the Purple Lounge acquisition. Compared to the same period last year, the results showed that revenue had grown from £2 million to £10.3 million and that pre-tax profit was £157,000, climbing from a loss of £898,000.

These are strong results from Media Corp, particularly as the Purple Lounge acquisition only took place during first month of the period under review. Much would have been done since that time to maximise the benefit from the acquisition.

Justin Drummond, CEO of Media Corp, commented:

“Following the board’s strategy to reduce overheads and move back in to online gaming via the acquisition of Purple Lounge, the first six months of the financial year represent a significant turnaround in the fortunes of the Group. Whilst the second quarter is seasonally the weakest quarter for the advertising network business, we have seen strong and profitable growth in the Group’s recently acquired gaming operation.

“The acquisition of Purple Lounge has given us a fast growing, profitable and hugely scalable business which can benefit from the Group’s extensive online marketing expertise. Whilst the main driver for growth has been in internet publishing through Purple Lounge, where revenue increased and the Board remains confident of an excellent outcome for the rest of the year.”

Turning to the outlook, Justin expressed confidence: ‘The second half of the financial year has started strongly, with record revenues across the Group in April. It is anticipated that this trend will continue and the Board remains confident of an excellent outcome for the rest of the year.’

In a research note issued on the day of the results, Growth Equities & Company Research (GE & CR) retained their Buy stance on Media Corp with an 8 pence target price. GE & CR has forecast earnings per share of 0.4 pence for the current year growing to 1.0 pence in 2011. As we go to press, Media Corp’s shares had risen by over 50% to 3.3 pence in the two days since the results were issued.

Justin Drummond

it is anticipated that

trend will continue

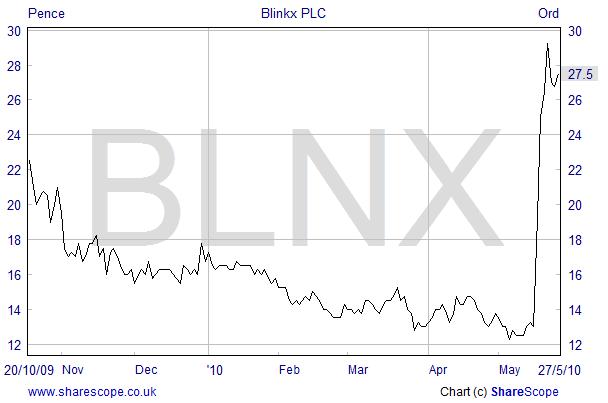

blinkx – ‘Nothing short of Transformational’

On 19 May blinkx issued final results for the year to 31 March 2010. We view these results as excellent. Suranga Chandratillake, founder and CEO of blinkx, went further: ‘While the full year financial results are excellent, our second half was nothing short of transformational as the business moved into EBITDA positive territory, ahead of expectations.’

The blinkx shares had been drifting downwards for some months, but these results have turned the shares around in no uncertain fashion.

Revenue in the second half was up by 57% on the first half at $20.6 million while operating expenses fell in the second half compared with the first. This tremendous growth was explained: ‘This exceptional performance was driven by the success of our unique advertising platform, which delivers targeted, ROI-guaranteed, brand advertising in online video, and has enjoyed widespread adoption by over 800 global brands.’

The CEO’s comments about the expansion and about future prospects are also extremely encouraging:

‘In the past 12 months, blinkx's traffic has surged 204% in the UK, making us the second fastest growing video site after Facebook, according to comScore. Moreover, the number of videos viewed over the Internet in the UK has shot up 37% over the same time period. This powerful groundswell towards online video underscores the strength and vitality of our business model.’

‘blinkx's aggressive audience growth, breaking into both comScore and Nielsen's Top 10 Video Sites, combined with our top-tier content partnerships, has enabled our business to flourish over the period, and we achieved a 112% increase in the number of brands advertising with us. We have continued to attract leading brand advertisers, including Coca Cola, Virgin and Toyota, while maintaining consistently high CPMs (Cost Per Mille), through the effectiveness of our unique Contextual Advertising platform, blinkx AdHoc. Online video is the fastest growing sector in advertising, and we expect to further accelerate the growth of our business based on this momentum.’

Investors and potential investors may be interested in the results presentation and Q & A (including some good questions) available on the blinkx site at http://www.blinkx.com/investors?category=Financial%20Results.

On the day of the results, Canaccord issued revised forecasts for blinkx which show pre-tax profits rising from £4.09 million in the current year to 31 March 2011 to £14.41in the following year. Earnings per share are given as 1.33 pence in 2011 and 3.29 pence in 2012.

Also on the day of the results, Blinkx launched a beta test version of its Mobile Video Search site – you can try it out at http://m.blinkx.com/.

expect to further accelerate the growth

Daniel Stewart

In a Trading Update issued on 21 May, Daniel Stewart reported that ‘Both April and May are expected to be profitable (un-audited) and, with the current business pipeline, the Directors are confident that this trend will continue going forward.’

The Update also reported that Adam Wilson has agreed that he will delay his permanent move back from the Middle East for 12 months. Mr Wilson will remain in the United Arab Emirates from where he is expected to source and execute new international business from a developing pipeline.

Whilst Adam Wilson remains in the UAE, Peter Shea will continue in his role as both Chairman and Chief Executive of the Company for a further 12 months. Mr Wilson has indicated that he intends to step down from the Board of Daniel Stewart as Non-Executive Director in the interim period.

Daniel Stewart also reported that it expected to issue its final results for the year to 31 March 2010 by the end of July. These results are expected to show revenues of approximately £4.0 million and a loss of around £3.0 million. Thankfully, the directors are expecting a much better performance in the current year.

Forbidden Technologies –‘enthusiasm, confidence and optimism’

Another company showing a rapid increase in turnover, albeit from a lower level, was Forbidden technologies. Forbidden issued its Final Results for the year to 31 December 2009 on 27 May. These showed that revenue for the year had increased by 131% to £280,826. Whilst this is still a relatively low figure, particularly for a company with a £15 million market cap, the company are extremely optimistic about the future. This paragraph from the Outlook statement conveys this well:

‘It is difficult to convey the enthusiasm, confidence and optimism that is felt by all of us who are involved at Forbidden. The increases in unsolicited enquiries about FORscene coming from different countries across the world indicate that awareness of our technology and its benefits are becoming widespread. The scale of business under discussion or negotiation increases from month to month. As a result we continue to see a very bright future and we sense that the opportunity to achieve scale is not too far away.’

The results showed a loss before tax of £56,670 which was down from (a restated) £76,401 in 2008. The Company reported that the board had adopted International Financial Reporting Standards (IFRS) for these results and consequently development costs are now capitalised – previously these costs had been written off to expenses. In the 2009 accounts £221,563 was shown as being used to purchase intangible fixed assets. Cash at 31 December 2009 was £211,225.

Just as we were going to press, Growth Equities & Company Research (GE & CR) published a research note on Forbidden. GE & CR have a buy stance on the shares with a target price of 87.8 pence (the shares closed at 20 pence at the end of May). The revised forecasts show the Company making a small profit in the current year. The forecast for 2011 is for a pre-tax profit of £310,000 with earnings per share coming in at 0.39 pence.

we continue to see

a very bright future

SeaEnergy

On 20 May, SeaEnergy announced that its partner in the Inch Cape Offshore Wind Farm, RWE npower renewables, wished to exit the project. This was due to the considerable size of the partner’s other onshore and offshore renewable generation commitments.

As a result, SeaEnergy and The Crown Estate are discussing the formation of a Memorandum of Understanding between The Crown Estate and SeaEnergy that will provide terms for the delivery of Inch Cape and may increase SeaEnergy's interest in the project.

SeaEnergy Renewables CEO, Joel Staadecker, commented: ’Inch Cape is an important site for Scotland, which expects to benefit from the construction and operation of offshore wind farms off the coast of central Scotland. We are delighted that The Crown Estate shares our commitment to the project and look forward to successful discussions to agree terms for its delivery. We are also very pleased at the prospect of potentially increasing our equity stake in what is a great project.’

Aimzine Comment: This could be good news for SeaEnergy in that it can now increase its exposure to this area, albeit with additional funding requirements. It would be very interesting to know why RWE npower chose this project to exit ahead of its other ‘considerable commitments’.

Crimson Tide

We mentioned in this article last month that Crimson Tide was developing its own proprietary mobile software products. The launch of the first of these products, designed for use in facilities management, was announced on 10 May. Known as mpro3fx, the product features a special 'before and after job' photograph facility and GPS "geotagging". Mpro3fx is to be rolled out for facilities management at one of the country's leading supermarket chains. Field trials are also being negotiated for the management and maintenance of over 5,000 ATM machines throughout the UK.

Barrie Whipp, Executive Chairman, commented: ‘mpro3fx is our first own brand software product and it incorporates our core scheduling, management and communications infrastructure. This is the first in a series of software products which we plan to launch over the coming months. We continue to be a full service company, but will now also be offering a range of products for a variety of applications, particularly in field service and healthcare.’

We are watching Crimson Tide’s product roll out with interest. Their products are entering a fast-growing market and success here could be most beneficial to this small company.

contract with leading supermarket chain

Sagentia

We were surprised to see Sagentia raising £8 million (before expenses) in a placing, at 40 pence per share, during May. This is a considerable sum for this small company. The new placing shares represent 47.9% on the share capital.

The placing, which was announced on 18 May, was at a small premium to the share price at the time of the announcement. It is encouraging to note that the two recently appointed directors participated in the placing. The Chairman, Martyn Ratcliffe, subscribed for 2,000,826 shares (i.e. over £800,000) while Non-executive Director, David Courtley subscribed for 375,000 shares.

The rationale behind the placing was set out in the following paragraph:

‘Following the acquisition of Martyn Ratcliffe's shareholding in March this year and his subsequent appointment as Chairman in April, together with the improved operating performance of the core consulting operations in the first three months of the current financial year, a review by the Board of the strategy of the Group has determined that Sagentia could benefit from an increase in the scale of its operations. This strategy could potentially include evaluating acquisition opportunities. Such acquisition opportunities could include businesses which have the potential to accelerate growth in an existing Sagentia business sector or could enable the Group to enter a new business sector or market that is complementary to the Group's current operations. Whilst the Group is financially stable and trading profitably, it does not currently have the cash resources necessary to pursue such opportunities.’

At the time of the placing Sagentia also gave a short trading update which reported that trading in the first three months of the current year has started well and the Group is trading profitably and ahead of the Board’s expectations. A similar trading statement was also included in the AGM statement announced two days later.

two directors

participated in

the placing

In Brief

Ultima Networks issued its Final Results for the year to 31 December 2009. These showed that the Group had made a pre-tax profit of £221,000, down from £281,000 in the previous year. The IT services division had performed strongly but the green technology division had suffered from a fall in market demand for its electric bicycles.

Ultima reported that it had completed a small solar park in Spain and is progressing with its much larger solar park in Italy. The Outlook statement concluded: ‘There remain challenges ahead in the economic conditions we face which will have an impact on all divisions of the business but we are confident that the milestones reached in 2009 will allow us to grow across all areas of the Group. The company will need to raise additional funding through borrowings in order to construct the solar parks planned for southern Italy and we are confident we will be able to find the extra funding necessary in order to continue to complete the projects and expand in this direction which we feel is an essential ingredient in the growth of the group and which we hope to deliver to the benefit of our shareholders over the coming years.’ Aimzine Comment: Securing this funding on acceptable terms will be a key factor for Ultima this year.

Planet Payment announced its first quarter 2010 results which showed continued year-on-year growth during its quietest quarter of the year. There was, however, news of recent regulation changes which may have some impact on Planet’s business going forward. The statement included news of recent VISA changes: ‘Additionally, the Company is currently reviewing the impact of recent changes to Visa International Operating Regulations including a new global regulatory scheme for DCC (Dynamic Currency Conversion) which was notified to Visa's participants on April 28 and became effective May 1, 2010, which amongst other things seek to limit new participants, including new merchant locations, from offering DCC services in North America and the Asia Pacific region.’ Since this announcement Planet’s shares have fallen from 140 pence to 87 pence, although part of this fall may have been due to weak market conditions.

Plethora Solutions announced on 5 May that it had raised £550,000 in a placing comprising new ordinary shares at 12.5 pence and convertible loan notes. Later in the month, on 17 May, Plethora announced that it had concluded agreements for the marketing and distribution rights for two prescription medicines to add to its Urology Company portfolio. Commenting, Steven Powell, Chief Executive Officer, said: ‘Throughout this first half of 2010 and we have continued to build the portfolio of approved products for The Urology Company, We are now focusing our attention on launching these products and building revenues through the second half of the year in line with market expectations.’

Scotty Group announced on the day of its AGM (18 May) that it had ‘received an expression of interest from a third party that may or may not lead to an offer being made for either the entire issued and to be issued share capital of the Company or the significant assets of the Company.’ The shares responded favourably gaining 5 pence on that day, before predictably slipping back.

Symphony Environmental announced that Non-executive Director, Hugo Swire had been appointed as Minister of State for Northern Ireland in the new UK Government and has consequently resigned as Non-Executive Director, in line with the principles laid out in the Cabinet Office's Ministerial Code guidance.

Synchronica announced two more contracts in Latin America – one in Panama and one in Argentina - to bring the total of new contracts announced in 2010 to seven. In the larger Argentinean contract, the operator will offer a push email and synchronisation service to its more than 13 million subscribers.

InterQuest (covered in Aimzine last month) issued a positive AGM statement reporting that they were seeing an increased level of trading in the first five months of the year, in line with expectations.

STOP PRESS: ViaLogy issued a comprehensive Business Update on 28 May in which it reported on progress with its latest oil wells. There was also news of a new contract for the security and surveillance business area. CEO, Robert Dean concluded the Business Update: "ViaLogy has accomplished a lot in the last six months. QuantumRD is gaining acceptance among a diverse client set; we are achieving repeat business; and the technology is being applied to an increasing variety of formations. As we provide more drilling locations to clients, we believe we can achieve a 'drilling queue' that results in regularised drilling activity. On a number of the jobs we've done we are able to indicate not just correct drilling locations, but also why previous drilling efforts have resulted in dry holes-business losses that might have been avoided had QuantumRD been applied. We have our sights set on winning contracts in shale gas and offshore applications, and with a number of key reference customers. Business operations are being managed to budget, and we are on plan with respect to fiscal year revenue goals. At the same time, we face resource constraints that prevent us from moving as aggressively as we would like. We are a new company in the oilpatch with a new technology, and winning commercial acceptance in such a highly specialised and experienced business community needs to be earned. I believe we are well on our way."

Written by Michael Crockett, Aimzine

Copyright © Aimzine Ltd 2010

RETURN TO AIMZINE FRONT PAGE | June 2010

|

||