Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. If you are not already registered to read Aimzine please click here

How would you like one of your shares to increase in value by a multiple of twenty five? That is just what has happened to AIM-listed Eurovestech. This High Technology Investment Company has turned a £2 million investment in Aim-listed ToLuna into £50 million.

Eurovestech announced on 14 July that it had realised a total of £14.8 million from the sale of part of its holding in AIM-listed Toluna. Eurovestech retains a 29.9% stake in ToLuna – this stake is valued today at £34.5 million. Eurovestech’s Chief Executive, Richard Bernstein, commented in the announcement:

‘If dividends are included, the total return, including the unrealised profit on our residual holding, from our £2 million investment in ToLuna is approximately £50 million. We are pleased that ToLuna has concluded a major acquisition which will make it an extremely powerful force in its global market. ToLuna has been, and remains, an excellent investment for Eurovestech.’

Toluna is not the only exciting investment in EuroVestech’s portfolio. In their 2008 Report and Accounts the Group list a further eight companies. These are shown in the table below:

|

Portfolio Company |

Percent Held |

Value at 31/3/08 £,000 |

Business Description |

KSS |

100 |

9,500 |

Price optimisation for Fuel Retailers and Refiners |

KSS Retail |

100 |

2,500 |

Price optimisation for Retailers |

Magenta |

41.9 |

3,079 |

Scheduling and Resource allocation technology |

MIST (France) |

46 |

1,156 |

Sound Separation Technology |

Lognet |

25.4 |

2,000 |

E-Billing Solutions Vendor |

ARKeX |

2.40 |

555 |

Airbourne Survet technology |

Tevet (Israel) |

1.9 |

80 |

Semi-conductor technology |

D-Pharm (Israel) |

0.23 |

121 |

Lipid-based drug development |

|

|

|

|

TOTAL |

|

£18,991 |

|

One Eurovestech company that has been doing particularly well recently is KSS Retail. This wholly owned subsidiary recently won a multi million dollar contract with a major US retailer, dunnhumby. KSS Retail will supply dunnhumby with its PriceStrat solution for price modelling and optimisation.**

Could there be another

‘25-bagger’ in Eurovestech’s portfolio?

KSS Retail is certainly

going the right way.

Discount to Assets

Whilst these are tough times for some of its early stage investee companies, we chose Eurovestech for this month’s ‘Snippet’ because it trades at a marked discount to its net asset value. Furthermore, the Group has an excellent investment record and now possesses a very healthy balance sheet. The current Market Capitalisation is only just above the sum of the Group’s Toluna stake and its cash.

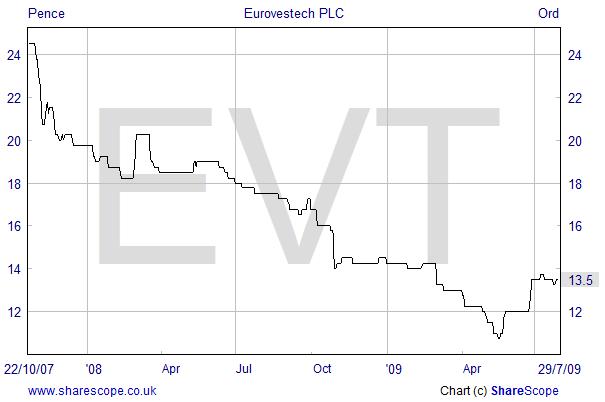

Eurovestech’s shares have fallen by almost 50% over the last 20 months and with the shares at 13.5 pence the market capitalisation is £46.5 million.

Could there be another ‘25-bagger’ in Eurovestech’s portfolio? KSS Retail is certainly going the right way. We recommend that potential investors read Eurovestech’s 2008 results, particularly the descriptions of each of the exciting investee companies – click here to download the full results document. Eurovestech’s 2009 final results are scheduled to be released in late September.

**STOP PRESS In an announcement issued on 30 July Eurovestech provided a trading update on the KSS and KSS Retail Companies. The RNS stated that KSS had suffered from some delayed orders but had just remained profitable and cash generative. Despite the somewhat disappointing results KSS Directors are: ‘anticipating a substantial increase in revenues and operating profits for the year to June 2010’.

To counter the somewhat disappointing report from KSS, there was excellent news from KSS Retail: KSS Retail more than doubled its unaudited revenue for the year to 30 June 2009, with an unaudited profit before and after tax of £1.2 million, the company's maiden profits. We are very pleased with the tremendous progress made by the company over the past 12 months and are confident that this year's achievements will underpin further strong growth in revenue and profits in the years ahead. As a result, the Directors of Eurovestech believe that the full year results to 30 June 2009 will reflect a substantial uplift in the current £2.5 million carrying value of KSS Retail. (our emphasis) |

| Aim Snippet Archive | |||||||||||||

|

|||||||||||||

Discuss this article

Written by Michael Crockett

Copyright Aimzine Ltd

RETURN TO AIMZINE NEWSLETTER HOME | August 2009

’

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |