RETURN TO AIMZINE NEWSLETTER HOME | June 2009

Meet the AIM Players...

Fund Manager –

Chelverton Asset Management

Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. If you are not already registered to read Aimzine please click HERE

This month we take a closer a look at a fund management company, Chelverton Asset Management.

In last month’s Aimzine, our CityInsider column considered the plight of fund managers during the market downturn – read this article here. This month in our ‘Meet the Players’ feature we take a closer a look at one fund management company, Chelverton Asset Management. Chelverton are a small group which specialises in investing in smaller companies.

I met up with one of Chelverton’s fund managers, David Taylor, at their London Office. As an active small cap investor, I found it fascinating to speak to a manager who considers the same stocks as I do. However, these fund managers have a somewhat larger ‘pot’ to manage than I do.

Chelverton manage three funds all of which are invested in smaller companies. Two of these funds are income funds and the third is a growth fund. One of these income funds is set up as an Open Ended investment Company (OIEC) whereas the other two funds are Investment Trust.

If you are unsure of the difference between an OEIC and an Investment Trust please click on these links to read what Wikipedia has to say about them: 1) OIEC 2) Investment Trust.

Chelverton is a small group with just 5 employees and much of their administration and marketing outsourced. For example, all fund purchases in the OIEC are made through Capita who are also responsible for calculating fund prices.

The Growth Fund

The smallest of the three funds is the Chelverton Growth Trust (Code: CGW) with funds under management of just £3.1 million. This investment trust is invested primarily in smaller companies, the majority of which are AIM-listed. At present this trust is trading at a discount of approximately 20% to its Net Asset value.

I asked David Taylor about the difficulties caused by the market downturn. He told me that the lack of liquidity in the market has been an issue for them. Another big concern for Chelverton is the number of AIM companies that are de-listing. At one time the managers would have considered directors owning in excess of 50% of shares as potentially a good thing. However, with directors easily able to de-list such companies, they now see such high director shareholdings as potentially negative.

The Growth Trust invests in companies with a market capitalisation of over £5 million and currently holds shares in 36 companies. AIM investors will recognise a number of the companies that appear on the list of the top 20 holdings of the fund – this list can be viewed on the Chelverton website here.

this trust is trading

at a discount of

approximately 20%

The Income Funds

Funds that pay a regular income have always been popular with investors. In today’s exceptionally low interest environment this popularity is likely to increase. Two Chelverton income funds are the only ones in the market investing primarily in small companies. The estimated yield on these small company income funds is currently 7.5% which should prove attractive to income seekers.

The first of the two income funds, the Smaller Companies Dividend Trust (Code: SDV), is an investment trust that was set up in 1999. This Trust has funds under management of approximately £15 million and currently trades at a discount to Net Asset Value (NAV) of around 10%. During better times the fund has been known to be quoted at a premium to NAV.

The second fund, the Chelverton UK Equity Income Fund, is an Open Ended Investment Company (OEIC) and was launched in December 2006. Today the fund size is £4.8 million. This fund was originally set up to invest in the same companies as the Dividend Trust. However, with poor liquidity in some very small cap companies in recent times, Chelverton has revised the investment criteria for the OIEC in order to invest in more liquid shares. (Unlike the ‘closed-end’ Investment Trusts, it can be necessary for the fund manager to sell investments in the OEIC portfolio to fund withdrawals.)

The estimated yield ......

is currently 7.5%

Selecting Stocks

I asked David how Chelverton pick stocks for their funds. He explained that the selection criteria for each fund are quite different. In terms of market capitalisation, their minimum size for the Growth Trust is approximately £5 million, for the Income Trust it is around £25 million and for the Income OEIC fund the market cap minimum is £40 million.

In the Growth Trust the managers are seeking to invest in companies which are at a ‘point of change’ in their development. In contrast, the focus of the income funds is on strong cash flows and dividends with the managers looking to invest in companies which pay dividends in excess of 6%.

Rather than using stock selection tools, the managers, who have been investing in smaller companies for many years, will ‘know’ most of the candidate companies for their funds.

When I asked David if they find it difficult to purchase stock in the smaller companies, he said that it can sometimes take a broker some days to get hold of stock but generally it is not a problem. The funds are also able at times to pick up stock in placings.

seeking to invest in

companies which are at

a ‘point of change’

Monitoring Progress

Once invested in a company the managers keep a careful eye on a company’s progress. Chelverton meet with Company Directors on a one-to-one basis at least twice a year – usually at the time of the Interim and Final results.

Chelverton do not get involved in any way with the day to day running of the companies that they invest in, although they are happy to be used as a sounding board if a company has any particular issue to resolve. They are particularly keen to have good non-executive directors in place who can contribute actively to the success of the business.

The Future

David is optimistic about the future for smaller companies over the coming years and, whilst he has been pleased to see their funds rebound strongly over the last few weeks, he is cautious about the outlook in the short term. Nonetheless, he believes that the Chelverton funds are an attractive proposition today.

Aimzine Comment

NB: Aimzine never provide advice on fund selection or purchase nor recommends that readers transact in shares or funds in any way.

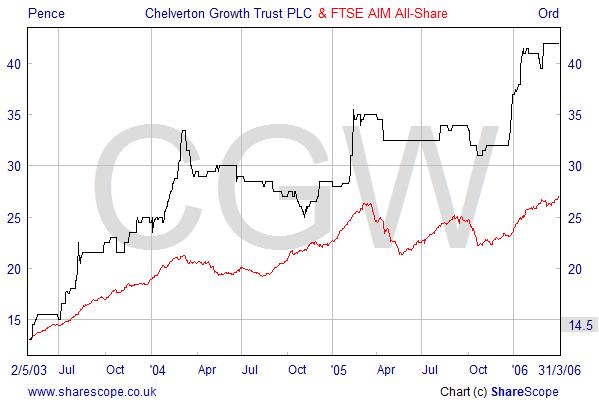

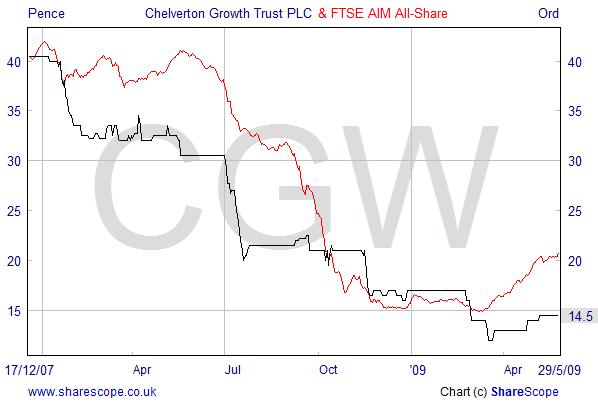

It has been a difficult time for Chelverton as its fund prices have fallen with the dire markets over the last 18 months. We reviewed the performance of the Growth trust against the AIM All Share index. As the two graphs below show, the Trust’s share price has strongly out-performed the AIM All Share index well when the market was rising but has somewhat under-performed the index during the bear market.

It should be borne in mind that the chart shows the share price of the Growth Trust, not the Net Asset Value (NAV). The share price of investment trusts usually trade at a greater discount to NAV when prices are falling. Also, this trust does have a small amount of gearing (currently 12%) – a good thing in a rising market!

They are particularly keen to

have good non-executive

directors in place

Strong out-performance during the rising market

No out-performance during the recent bear market

The Chelverton funds offer a convenient way to gain exposure to a basket of small company shares

All three of these funds can be purchased in an ISA – unlike many AIM shares.

Chelverton’s funds have performed well against the market during a bull market in the past and it will be interesting see if this strength repeats itself when, eventually, the market shows sustained improvement.

The small company income funds offer a generous return at a time when interest rates are very low. As noted earlier, the fund managers look to invest in small companies with strong cash flow and this approach may appeal to some fund investors during these difficult times.

Fund Managers such as Chelverton are vital ‘players’ in the small cap market-place and we are keen to see them prosper.

We would welcome any questions or comments in relation to this article. Please click here or add a topic in Aimzine Social here.

Chelverton’s funds have

performed well against the

market during a bull market

If you would like to comment on this article please click here

Written by Michael Crockett

Copyright Aimzine Ltd

RETURN TO AIMZINE NEWSLETTER HOME | June 2009

| Meet the Players Archive | |||||||||||||||||||||

|

|||||||||||||||||||||

’

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |