Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. If you are not already registered to read Aimzine please click here

The Aimzine Snippet column each month highlights an announcement or situation which we believe is worthy of further investigation

This month we have selected a company which has had some substantial director dealing. Not that directors always get it right. Evidence the purchase of £50,000 worth of shares purchased by Barry Asher, non-executive Chairman of Relax Group, in February. This purchase was made at £1.00 per share, which was at a considerable premium to the price at the time. Eight month after this purchase, in early October, Relax’s shares were suspended at 11.5 pence, ‘pending clarification of the company’s financial position’.

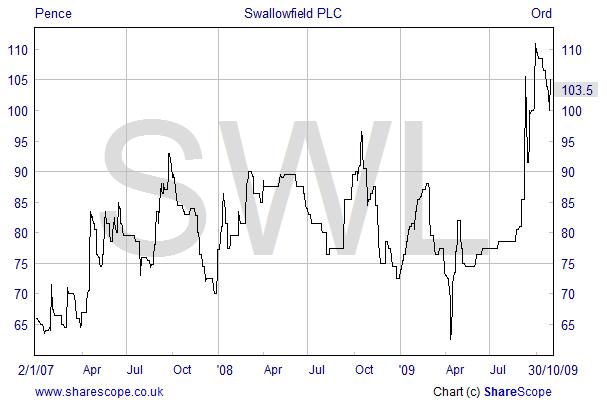

Today’s ‘Snippet’ seems a less risky proposition than Relax and the share purchases are ‘across the board’. The Company in question is Swallowfield which describes itself as a full service provider for global brands and retailers operating in the cosmetics, personal care and household goods market.

On 15 October Swallowfield announced that Chief Executive, Ian Mackinnon, had exercised options on 50,000 shares at 73 pence. Further, Mr Mackinnon had also sold 21,000 shares at the prevailing price of £1.03 to four directors or their spouses. This was the first report of director share purchases at Swallowfield in 2009. In 2008 the Company reported director share purchases on 5 occasions. In total these 5 purchases exceeded 100,000 shares.

In their results to 30 June 2009, Swallowfield reported revenue growth of 10% to £49.1 million. Earnings per share increased by 4% to 9.6 pence. The Company also increased its dividend by 7% to 5.9 pence. The accounts show net debt of £3.36 million and net assets are reported as £12.7 million as compared to a market capitalisation of £11.3 million.

In is interesting to note that included within the Company’s assets is Freehold Land and Buildings valued at £5.6 million. We further note that the largest shareholder is AIM specialist, Peter Gyllenhammar who holds 29.8% of the shares. We have reported in the past that Mr Gyllenhammar is often interested in companies with substantial property assets.

The Company’s broker forecasts that growth will continue over the next two years. The forecasts show earnings per share of 9.77 pence in 2010 and 10.61 pence in 2011.

Swallowfield has performed extremely well during difficult conditions. The directors purchases show a sign of confidence that this good performance will continue.

Swallowfield has performed extremely well during

difficult conditions

| Aim Snippet Archive | |||||||||||||||||||

|

|||||||||||||||||||

Written by Michael Crockett

Copyright Aimzine Ltd

RETURN TO AIMZINE FRONT PAGE | November 2009

’

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |