Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. If you are not already registered to read Aimzine please click here

Each month we trawl through hundreds of RNS statements from AIM companies. In this column we will highlight an exceptional item from an AIM company, particularly where we feel the market may not have priced in recent news.

Every week hundreds of new contract announcements are made by AIM companies. A high percentage of these are reporting quite small contracts which have little effect on the value of the company. However, some contract announcements relate to substantial contracts which will have a major positive effect on future company results. Today we highlight a company which has recently reported two very significant contracts and yet its share price has been little moved by the announcements.

The Company in question is Nature Group (NGR). Nature provides environmentally friendly waste water treatment solutions to the oil & gas and marine industries. Nature has operation centres in Stavanger, Norway and Gibraltar. Nature Group, at the current 23.25 share price has a market capitalisation of £9.0 million.

To give a flavour of Nature’s current trading I will first look at the most recent results and then review the two significant contract announcements.

Interim Results

Nature Group issued its Interim Results for the six months to 30 June 2009 in September 2009. These showed excellent progress and the Group reported an improved pre-tax profit of £574,180 for the six months. Basic earnings per share increased from 0.78p (H1 2008) to 1.48p for the first six months of 2009. In considering the Group’s prospects Chairman, Richard Eldridge reported:

‘Despite the delivery of the Kazakhstan contract in the first half and the reduced revenues from Northern Treatment referred to above, we expect these adverse factors to be counter balanced by continued buoyancy in revenues from the Gibraltar and Tananger operations, with the result that attributable Group turnover for the full year should exceed £5 million. This would translate into a substantial increase in Group net earnings for the year ending 31st December 2009, particularly at the pre-depreciation level. However, at this stage your Directors believe it prudent not to make a formal profit forecast for the full year.’

‘As indicated earlier in the year, due particularly to the strong cash generation of the Group's port operations, your Directors consider that a dividend policy should be initiated. Accordingly, if our revenues and earnings for 2009 continue to maintain the first half trend, it will be intended to propose a dividend in the region of 0.5p per share to be paid next year from our 2009 net earnings.’

From the tone of the statement it seems likely that the second half of 2009 should be at least as good as the first and thus earnings per share of at least 3p are likely. At the current share price this would equate to a p/e ratio of just under 8, which, for a growing company, seems at least ‘good value’.

Contract One

On 27 November 2009 Nature Group announced that it had received a letter of intent for a contract for site construction of tankage and waste treatment facilities at the Oman Dry Dock, Duqm Port in the Sultanate of Oman. The letter of intent and anticipated contract have expected gross revenues for Nature (through a wholly owned subsidiary) of approximately US$4.2 million. Nature reported that approximately 70 per cent. (C £1.78 million at the then current exchange rates) of the revenues from the project would be recognised in 2010. Furthermore, it is anticipated that Nature will derive ongoing support service revenues following the planned completion of the facility.

Contract 2

On 25 January Nature announced that its port waste and environmental treatment subsidiary in Gibraltar, Nature Port Reception Facilities Ltd has signed 2 additional transhipment licences for the transportation of oil slops and wastewater to the Group's facility in Gibraltar. The facility has the throughput and storage capability to handle up to 200,000m3 of slops and wastewater per annum.

A significant percentage of Nature’s revenue comes from the Gibraltar facility. In 2009 the Group processed approximately 67,000m3 of oil waste waters in Gibraltar. The Chairman anticipated in the RNS that ‘these new agreements could increase the amount processed annually by up to 40,000m3 (subject to actual volumes received) which would significantly increase the revenue generated by the Group.’

Summary

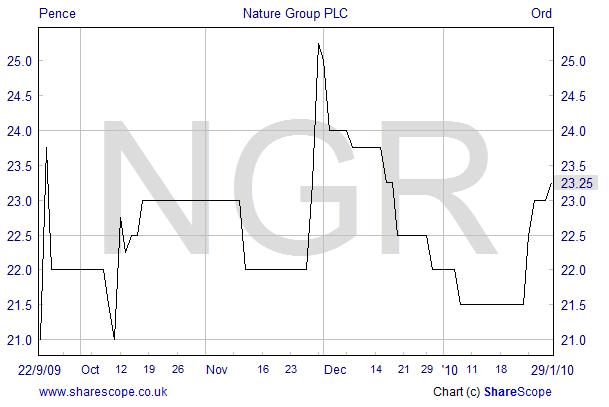

Here we have a small yet successful and growing AIM Company soon to declare its first dividend. Add to this two new and significant contracts which could easily add £2 to £3 million of additional revenue in 2010 (compared to the £4.5+ million anticipated in 2009). Now take a look at the share price movement resulting from these contract announcements:

a p/e ratio of just under 8

significantly increase the revenue generated by the Group

The chart covers period from the announcement of the Interim Results in September. You will note that there has been small ‘upward twitches’ in the share price following each of the contract announcements (In late November and late January) but still the share is only fractionally above the level at the time of the Interims.

There is a lot more to Nature Group than we can cover in this column. As always, the purpose of this Snippet column is to highlight an interesting situation worthy of further research.

upward twitches in the

share price

| Recent Aim Snippets | |||||||||||||||||||||||

|

|||||||||||||||||||||||

Written by Michael Crockett

Copyright Aimzine Ltd

RETURN TO AIMZINE FRONT PAGE | February 2010

’

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |