Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. If you are not already registered to read Aimzine please click here

Each month we trawl through hundreds of RNS statements from AIM companies. In this column we will highlight an exceptional item from an AIM company, particularly where we feel the market may not have accounted for recent news.

Last month the Snippet column featured Nature Group. I highlighted how the share price had hardly moved despite the announcement of two very significant contracts. Since we published our article Nature’s share price has increased from 23.25 pence to 36 pence (on 26 February) – a healthy rise of 56%.

As always I have considered a number of candidates for this month’s Snippet column. I had one particularly exciting ‘potential snippet’ but its share price has galloped away to a level such that the value is less obvious. Instead, for this month’s Snippet, I am returning to a news item that was released by Cellcast (CLTV) at the beginning of February. Like several other companies featured in Aimzine this month, Cellcast is in the microcap category having a market capitalisation of just £3.7 million.

Introduction

Cellcast develops and distributes mobile and participation TV applications and produces live interactive pay-to-play programming. The Group listed on AIM in 2005 and has had a rather chequered history.

The shares, which peaked at 94 pence in April 2006, fell disastrously to an all time low of 0.4 pence by October 2008. The fall in share price was caused by a number of problems. For example, the Group was hit by the issues around participation TV and also by Sky making changes to its Electronic Programme Guide. These and other difficulties have been exacerbated by a shortage of funds. We are not able to judge to what extent any of Cellcast’s problems have been of its own making.

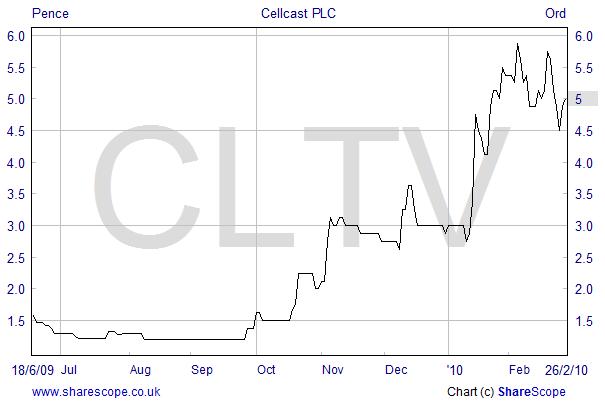

As can be seen from the share price chart above, things have been improving for Cellcast. In the Interim results to 30 June 2009, the Group was able to report that it achieved a positive EBITDA of £70,000. This compared to a loss of £550,000 in the equivalent period of 2008. Much of the improvement was due to the Company cutting cost. The full interim results can be read here.

a number of problems

Subsequently, in a trading statement issued on 9 December, Cellcast has indicated that it has incurred substantial front-end costs in the second half of 2009 investing in 5 new television channels. The statement continued: ‘We anticipate the costs of this investment will be recouped from revenues in the second half of 2010 but will have a negative impact on the Group's second half 2009 performance to the extent that such costs cannot be capitalised under current IFRS rules. In the closing months of 2009, revenues from new distribution are already indicatively tracking above our internal projections and our expectation remains that the Group will still report year-on-year revenue growth compared to 2008.’

year-on-year revenue

growth

The Exciting Bit

The reason we selected Cellcast for this month’s Snippet is because of the success of the Group’s 37.5% owned subsidiary, Cellcast Asia Holdings (CAH). News of improving results at CAH were first mentioned at the time of the interim results. These were released at the end of September when the Chairman reported progress on CAH as follows:

‘As reported in the 2008 Annual Report, Cellcast Asia Holdings ('CAH'), the Group's 37.5% owned Asian affiliate made profits in March and April 2009, and this continued during May and June. The Group's share of losses in CAH totalled £47,500 in January and February 2009, but subsequent profits resulted in a share of losses in CAH in the six months to 30 June 2009 of £15,000 compared to £179,000 in the same period in 2008. CAH has continued to be profitable in July and August, and the directors are optimistic that this trend will continue. The carrying value of the Group's interest in CAH at 30 June 2009 was £240,000, which the directors believe to be a fair value. CAH has now achieved six months of sustained profitability and has seen significant revenue growth quarter by quarter. It is now the recognised market leader in the Indian participation TV sector, broadcasting a diverse range of formats on ten different channels.’

The highlighted section shows that CAH was just loss making in the first half of 2009 but was becoming profitable on a monthly basis. We had further news in December 2009 that CAH’s revenues were advancing rapidly. However, the news issued on 4 February was quite astounding. The Group announced that CAH’s revenues had grown by 400% to $6.4 million in the second half of 2009 and that for this period CAH would report a profit of just over $2 million. (Note the carrying value above of just £240,000 for Cellcast’s share of this business!)

CAH is forecasting continued growth in 2010 and is expecting the growth in the Indian mobile market to continue apace. They quote an increase of 19 million new mobile subscribers in India for the month of December 2009 alone!

This Cellcast India website shows some of CAH’s revenue generating programmes.

the news.... was quite astounding

The Opportunity

There is currently only limited information available about prospects for CAH. We know that it made an H2 profit of $2 million in 2009 and is growing rapidly. However, we know nothing about the competitive landscape nor of any details of the accounts. For example, it could be that the $2 million profit was partly due to an exceptional item.

Nonetheless, there must be a fair chance that CAH will continue to grow profitability during 2010. However, for the sake of illustration, let us assume that profitability was just maintained at the H2 rate. With this assumption CAH would make a profit of $4 million this year, equivalent to approximately £2.7 million. If it did achieve this level, Cellcast’s share of this profit figure would be approximately £0.5 million. Remember that this assumes no further growth in 2010.

Given that Cellcast’s total market capitalisation is only £3.7 million, CAH could prove to be worth a lot more than this figure.

Needless to say, there are considerable unknowns about the future for Cellcast and CAH and any investment in Cellcast must be considered as high risk.

There is a lot more to Cellcast than we can cover in this column. As always, the purpose of this Snippet column is to highlight an interesting situation worthy of further research.

Cellcast's share ....

would be approximately

£0.5 million

| Recent Aim Snippets | |||||||||||||||||||||||

|

|||||||||||||||||||||||

Written by Michael Crockett

Copyright Aimzine Ltd

RETURN TO AIMZINE FRONT PAGE | March 2010

’

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |