Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. Register here to read this month's Aimzine |

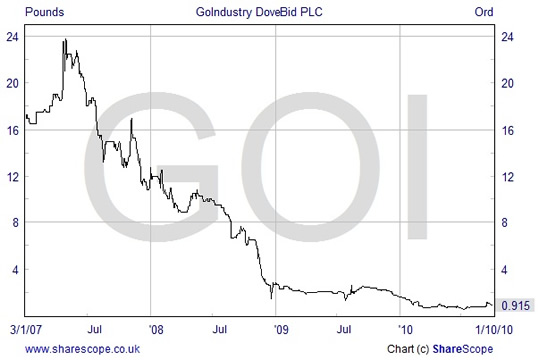

This month we have selected GoIndustry DoveBid (Epic: GOI) for the Snippet column. GoIndustry is a worldwide business with offices in over 20 countries. The Group helps organisations to dispose of surplus industrial assets primarily through an online auction website – see http://www.go-dove.com/. As the chart below shows, GOI has yet to live up to its earlier promise.

GoIndustry has some negatives which will deter many investors. For example, it has a pensions deficit of £4.2 million and even though its Net Assets are stated £25.9 million this includes intangible assets of £32.5 million. GOI has a market cap of £9 million at a share price of 91 pence.

Looking back over results for recent years, the company had shown some promise until 2008, when it was badly hit by the recession. During 2009 the Group underwent a major restructuring resulting in a lower cost base. Furthermore, £4.5 million in loan notes were converted in to equity which has greatly reduced the Group’s finance costs.

GOI has yet to live up to its promise

Interim Results

We consider that the Group’s interim results, issued on 23 September show that very good progress is being made. GoIndustry reported a return to profit at £151,000 (before non-cash exceptional of £560,000). We found the Chief Executive’s outlook statement encouraging:

‘We continue to implement our strategy to position the business for growth by signing up more Corporate Forward Flow Accounts. This will bring greater visibility to our revenue, and improve our profits and cash flow. It will also enhance our Industry Exchanges so that they become the trading platform of choice. Furthermore we expect to benefit from improved performance from our existing products and services as momentum within our markets gathers pace.’

‘During the second quarter we have expanded our service offerings to large corporations with the launch of "Go-Optimize". This is a turn-key programme, which enables our clients to identify hidden value in their assets, providing full visibility and management of their worldwide plant and equipment. These managed services include valuations, redeployment, online auctions, other methods of asset sale and fulfilment services. A number of our largest clients already take advantage of many of these services and regard GoIndustry DoveBid as their key global partner.’

‘Taking into account each of these factors, we anticipate continuing improvement in the Group's performance in the second half of 2010.’

anticipate continuing improvement

Considerable scope

The Group believe that there is considerable scope for further growth in their business and certainly other companies have found that a lot of money can be made from online auctions. We have also been encouraged by recent share purchases by the Chairman and another Non-executive Director.

GoIndustry’s broker, W H Ireland, issued forecasts for the Group on the day of the interim results. The forecasts show earnings per share growing from 4.5 pence in 2010 to 7.5 pence in 2011 and 18.8 pence in 2012 – equating to a 2012 price/earnings ratio of 5.8.

So, in summary, GoIndustry DoveBid is not without its risks but it should be worth monitoring - particluarly looking for further progress with the restructuring and re-focusing of the business. The early signs are promising.

As always, the purpose of this Snippet column is to highlight an interesting situation worthy of further research.

price / earnings ratio of 5.8

Copyright Aimzine Ltd

y without prior consent. ADVFN will BAN those who post AIMZINE articles without prior permission.

| Recent Aim Snippets | |||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |