Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. Register here to read this month's Aimzine |

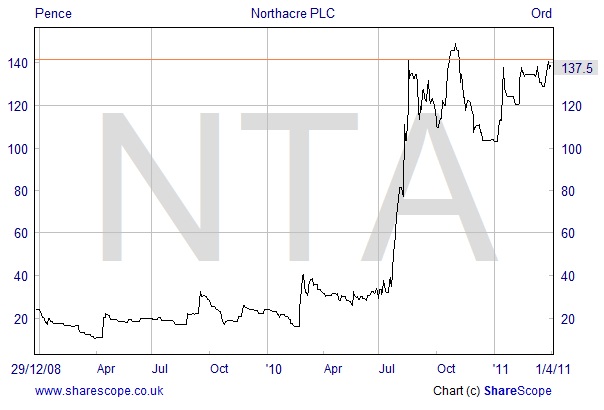

This month I want to highlight an interesting position with Northacre (NTA), the up-market London property developer. Northacre’s major project is The Lancasters – this former Hyde Park hotel is being redeveloped into expensive apartments in a joint-development with the fully listed property company, Minerva.

There are three reasons why we would like to bring Northacre to readers’ attention:

-

The Lancasters project is nearing completion: In Minerva’s interim results issued on 22 February it was reported that 60% of the available units had been sold. The Lancasters project is due to be completed in 2011 and new show apartments will be opened soon to entice some further buyers.

I attended Northacre’s AGM last summer and I remember the directors being asked a question regarding when and how they were planning to secure the sales of the remaining apartments. At that time one of the Northacre directors explained that they were in no hurry to sell the remaining apartments because they felt that Northacre would achieve better prices in the summer of 2011 when the site was nearing completion. At this time potential customers could see the attraction of this exceptional development with the new show apartments, the private garden, reception areas and other facilities.

Regarding the valuation of The Lancasters, Minerva booked a £16.5 million net valuation increase on its share of the development in its results (now carrying the property at £368 million). Northacre’s share of the profits on The Lancasters is determined by a profit sharing formula as explained in this RNS.

-

Northacre announced an upbeat Trading Statement in February 2011. As well as reporting on good progress at The Lancasters, the statement reported strong trading at Northacre’s Interior Design and Architects subsidiaries. Also, it was reassuring that Northacre had been able to secure a £2 million loan facilty from the father of Mohamed AlRafi, a Board Director and major shareholder.

.

-

Stake building. Over recent weeks there have been a number of ‘Holding in Company’ announcements which have reported that Middle East Properties Companies Limited (MEPC) , a Company Registered in British Virgin Islands has been taking a rapidly growing stake in Northacre. At the last announcement MEPC’s holding had reached the 9% level.

.

Of course the key question is what value to attribute to Northacre’s property assets and in particular what is the value of the Lancasters, which is by far NTA’s most valuable asset. We recommend anyone interested in Northacre to take some time studying the latest results from Northacre and Minerva to determine an approximate valuation of Northacre’s share in The Lancasters. Anyone attempting this exercise should bear in mind 1) the tranches of the profit sharing formula and 2) that Northacre’s profits are likely to be liable to tax. We believe the valuation that you arrive at from this exercise may be substantially higher than Northacre’s current £37 million market capitalisation.

As always, the purpose of this Snippet column is to highlight an interesting situation worthy of further research and monitoring.

The Lancasters

no hury to sell remaining apartments

had reached the 9% level

Copyright © Aimzine Ltd 2011

Return to: April AimZine Front Page

y without prior consent. ADVFN will BAN those who post AIMwithout prior permission.

| Recent Aim Snippets | |||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |