AIM Snippet

A GR8 Opportunity?

Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. Register here to read this month's Aimzine |

Important Note: This article is copyright of AimZine Ltd. No part should be copied, reproduced or distributed in any way without prior consent. This means that it is illegal to post Aimzine content on bulletin boards without prior permission.

Each month we trawl through hundreds of RNS statements from AIM companies. In this column we highlight an exceptional company announcement, particularly where we feel the market may not have taken full account of recent news.

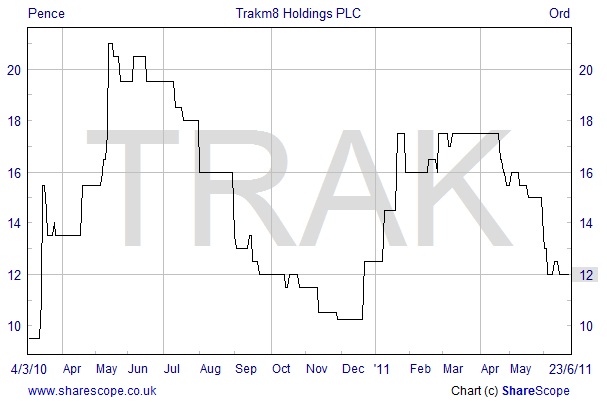

For this month’s Snippet column I am turning to the results from an AIM minnow, Trakm8 Holdings (TRAK). Trakm8 designs, develops, manufactures, supplies and supports vehicle tracking, fleet tracking and GPRS/GPS tracking products and services. The company provides both hardware and software telematics solutions.

Trakm8 issued its results for the year to 31 March 2011 on 23 June. The results (which can be downloaded from Trakm8’s website here) reported strong progress and included these financial headlines:

• Revenue growth of 22% to £4,186k

• Operating profit increase of 19% to £329k

• Cash balances increased by £427k to £1,119k

• Net assets increased by 11% to £2,236k

The reported results were in line with expectations set by house broker, Arbuthnot. On the day the results were issued Arbuthnot reported that it would retain its ‘Strong Buy’ rating on Trakm8 and leave forecasts for 2012 and 2013 unchanged – see below.

Year to 31 March... |

2011 (actual) |

2012 (Estimated) |

2013 (Estimated) |

Revenue (£m) |

4.2 |

4.3 |

4.5 |

Pre-tax Profit (£m) |

0.3 |

0.4 |

0.5 |

Earnings per share (p) |

1.1 |

1.6 |

2.0 |

Driving Growth

Trakm8’s Chairman, Dawson Buck was optimistic about future plans in his Outlook Statement:

“The Board is confident that the revenue and profitability growth of the Group can be continued over the next 12 months.”

“Trakm8 solutions are expected to increase market penetration both in the large fleet market and the SME space. The installed base and its consequent recurring revenues are expected to continue to increase with the monthly recurring income increasing as a percentage of our underlying overheads.”

“With the wider opportunities for hardware only sales provided by having lower cost products the Group is confident that the volume of units sold will increase strongly in the coming year. This will benefit not only the sales and profitability directly but will also help reduce product manufacturing costs in the longer term.”

“We believe that the financial justification of implementing telematics based fleet management solutions is now compelling. Trakm8 has positioned itself to benefit from the situation with exceptional cost effective integrated solutions. To protect the technical superiority of our products and services and to ensure the lowest possible cost base, we will continue to expand the engineering and professional services teams.”

“Trakm8’s primary focus is to continue to drive growth in revenues and profitability and therefore this will be a primary use for cash generated by operations. However we have been very successful in building our cash reserves and we are keen to examine all other expansion options including acquisitions to enable us to achieve our growth plans. The telematics market in the UK remains very fragmented and the Group is in a strong position to benefit when favourable opportunities arise.”

Thus there would seem to be plenty of opportunities to achieve growth over the medium and long term. In the short term the board’s confidence will no doubt be helped by the two new contracts which were announced in January 2011.

Trakm8's T8 Telematics Device

confident of revenue and profitability growth

very successful in building

cash reserves

The shares

At 12 pence per share Trakm8 has a market capitalisation of just £2.3 million. Only 49% of the shares are declared as being in public possession. Understandably, for such a small company with only about £1 million of shares in circulation, there is a wide spread and the shares may be difficult to trade.

At the time of writing this article (24 June) TRAK’s shares were trading at bid: 10 pence, offer: 14 pence – a pretty daunting 29% spread. However, when I requested an online quote through Barclays, I was offered 25,000 shares at 12.5 pence.

Summary

In summary, Trakm8 has issued some promising results showing good growth and improving cash generation. The shares are on a lowly rating (2013 p/e of 6) and IF the Company can achieve its growth objectives and scale up the business it is likely that this rating will improve.

As always, the purpose of this Snippet column is to highlight an interesting situation worthy of further research and monitoring.

at 12 pence per share Trakm8

has a market capitalisation

of just £2.3 million

Copyright © Aimzine Ltd 2011

Return to: July AimZine Front Page

y without prior consent. ADVFN will BAN those who post AIMwithout prior permission.

| Recent Aim Snippets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |