AIM Snippet

Growth prospects from video gateways

Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. Register here to read this month's Aimzine |

Important Note: This article is copyright of AimZine Ltd. No part should be copied, reproduced or distributed in any way without prior consent. This means that it is illegal to post Aimzine content on bulletin boards without prior permission.

Each month we trawl through hundreds of RNS statements from AIM companies. In this column we highlight an exceptional company announcement, particularly where we feel the market may not have taken full account of recent news.

This month for the Snippet column we turn to SerVision, a small Israel based AIM-listed Company with some interesting technology. SerVision’s products, called video gateways, provide live and recorded video transmission from CCTV cameras over cellular and IP networks systems for live and recorded video streaming. video gateways can send high quality live pictures smoothly over 2.5G and 3G narrowband networks, such as cellular telephones and PDAs, enabling owners or security staff to monitor their offices and homes from anywhere in the world.

The Company’s video gateways are used in many different settings including fixed and mobile commercial systems, home security and body worn camera systems. The devices are in use by taxi firms and by police in a number of different countries. The CVG device pictured here can be used at bank ATM machines – for details see the description here (to view other uses for the video gateways click on ‘applications’ on the menu bar in the preceding link).

After many months with little news reported, SerVision announced no fewer than three new distribution agreements in the second half of July. These new deals come on top of recently announced improving results. Furthermore, news is expected soon which will help strengthen the Company’s working capital position.

Results and forecasts

SerVision issued its results for the year to 31 December 2010 on 30 June. Despite being issued rather late the results were encouraging and showed that, although turnover was virtually unchanged, Net Profit for the year was up from $193,000 to $641,000.

Chairman and CEO, Gideon Tahan’s results statement was encouraging and I have selected below two separate extracts that indicate the potential for an exciting future at SerVision:

"2010 was a definite step forward for the Company, as we extended a number of projects with some of our existing clients and also began high-profile trials with new clients across a range new market segments, such as airports, ATMs, taxis and train companies, into countries as diverse as Colombia, India, Kazakhstan, the US and Russia. Our breadth of new contracts is evidence that our products continue to gain traction globally. The Board continue to believe that our patented compression technology remains amongst the most technologically advanced on the market."

“I am pleased to report on SerVision's upward trend of profitability throughout 2010 and I remain optimistic about SerVision's growth prospects into 2011. Following the launch of our CVG-M series of products in 2010 designed for use in smaller vehicles such as taxis we have entered into a market that we view with significant growth potential. In addition the pipeline of new distribution agreements remains healthy.”

To view the rest of the results statement please click here.

Shortly after the results were issued (and before the distribution agreements below were announced) SerVision’s broker, Allenby Capital, issued a research note which included forecasts for the full 2011 year – see table below.

Year to 31 December.. |

2010 (actual) |

2011 (Estimated) |

Revenue ($m) |

5.3 |

7.0 |

Pre-tax Profit ($m) |

0.6 |

0.7 |

Earnings per share (c) |

1.5 |

1.4 |

three new distribution agreements

Gideon Tahan

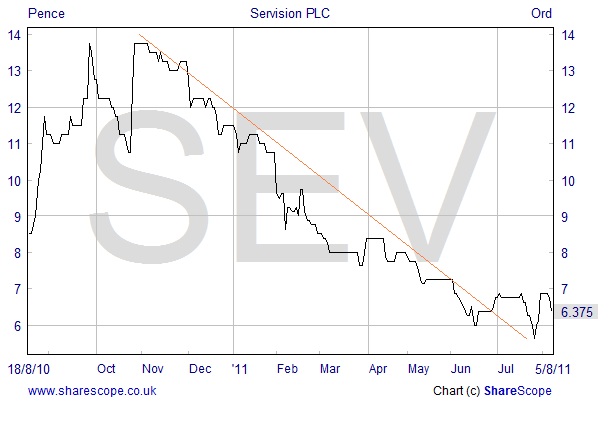

The Shares

SerVision’s shares have not had a happy time in recent months although it would seem that the downtrend has been broken and a base may be forming.

Gidon Tahan, Chairman and CEO holds 18% of the shares.

Distribution Agreements

In an RNS issued on 18 July SerVision announced two new distribution agreements, one in Mexico and the other in the UK.

In Mexico Cashfin has signed an agreement to exclusively distribute SerVision’s products. Under the terms of the agreement, which is for an initial duration of 2 years, Cashfin has committed to an order schedule comprising a total of 4,000 units. SerVision have received a $300,000 cash payment from Cashfin for an initial order of 500 units.

The UK agreement is with Cobra, the European market leader for GPS stolen vehicle tracking and location based services. Under the terms of the Cobra Agreement the Company has agreed to supply MVG and CVG-M products to Cobra, to be white labelled and sold under the Global Live brand name. Cobra has placed an initial purchase order which has been successfully fulfilled.

On 29 July the Company announced news of a third distribution agreement, this time with Graphic Image Technologies (GIT) in South Africa. The exclusive agreement with GIT is for the import and distribution of SerVision's complete range of video gateway products in South Africa, Namibia, Botswana, Lesotho, Mozambique and Swaziland.

The agreement is again for an initial 2 year period and GIT has committed to place orders for an aggregate value of $2.0 million with orders cumulatively valued at USD 1.0 million due prior to 20 June 2012. SerVision has received an initial purchase order with an aggregate value of $150,000 for the initial shipment of products.

the shares have not had

a happy time in

recent months

European market leader

aggregate value of $2million

Balance Sheet and China

On 1 February SerVision announced that it had raised £725,000 (gross) in a placing at 8 pence per share, stating at that time that the proceeds of the Placing will be used for general working capital purposes and to promote the commercialisation of the Company's product base.

Pressures on working capital for a growing products company can be very difficult to manage and the funds received from the distribution deals above will be very useful in this respect. Additionally the Company is expected to announce shortly some product deliveries from China which should also serve to strengthen the balance sheet. The China product deliveries are explained in the paragraph below from the recently released results:

The Company also announced in May 2010 a manufacturing rights agreement with Rich Wonder Technology Limited to manufacture all of SerVision's narrow band-width video gateway products to be sold in China and other authorised territories. Under this agreement the consideration payable to SerVision was US$2.0 million of which US$600,000 was settled through payment of cash to SerVision with the balance being settled through the supply of 3,730 of SerVision's MVG 400 units (which at the manufacturing cost of US$375/unit have a value of US$1.4 million). A production line has been established in China and quality control has been undertaken on the production line of the stock manufacturer. The Board at SerVision is happy with the progress being made on the establishment of the production line in China and expect to start receiving delivery of the MVG 400 units shortly.

Summary

SerVision is a small company at an interesting point in its development. It is lowly rated, profitable and seems to have good prospects for growth. Furthermore it operates in a fast growing area. At this point I should state that we have not researched this market in depth and do not know the strength of the competition nor do we have independent verification of SerVision’s claim its patented compression technology is amongst the most technologically advanced on the market. Nonetheless, from what we have seen reported, progress is encouraging.

As always, the purpose of this Snippet column is to highlight an interesting situation worthy of further research and monitoring.

should also serve to

strengthen the balance sheet

Copyright © Aimzine Ltd 2011

Return to: August AimZine Front Page

y without prior consent. ADVFN will BAN those who post AIMwithout prior permission.

| Recent Aim Snippets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |