AIM Snippet

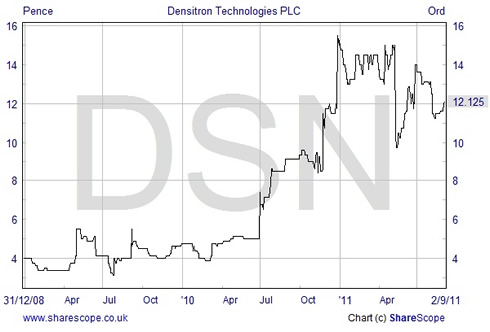

Displaying good growth

Aimzine is a FREE online magazine for investors and everyone involved with AIM companies. Register here to read this month's Aimzine |

This month we highlight the positive interim results of Densitron Technologies, a small AIM-listed company, whose business is primarily in the design, development, marketing and selling of electronic displays.

Densitron’s interim results for the six months to 30 June 2011 were issued on 23 August and showed that orders booked during that period were up 6% to £11.2 million and that the Group achieved an operating profit of £0.54 million compared with £0.15 million for the first six months of 2010. The Company stated that this operating profit was: “ahead of our internal forecast and confirms that the business is well on track to achieve market expectations for the full year.”

House broker, Westhouse Securities, issued forecasts at the time of the interim results which indicate that both earnings and dividends are predicted to grow strongly this year and next. At the time of writing Densitron’s shares are trading at 12 pence indicating a 2012 price/earnings ratio of under 6.

"...well on track to exceed

market expectations"

Year to 31 December.. |

2010 (actual) |

2011 (Estimated) |

2012 (Estimated) |

Revenue (£m) |

20.77 |

22.80 |

25.70 |

Pre-tax Profit (£m) |

-0.57 |

1.3 |

2.0 |

Earnings per share (p) |

0.73 |

1.48 |

2.15 |

Dividend per share (p) |

0.30 |

0.60 |

0.80 |

Dividend Payments

Readers may notice in the table above that the Group reported a loss in 2010. However, this is explained by a £1.17 million loss on the sale of its investment in Evervision, a Taiwanese display manufacturer. This investment was disposed of in 2010 for £3.9 million. Investors were paid a special dividend and capital reduction totalling 5 pence per share in May 2011, primarily from the proceeds of the Evervision sale.

As can be seen in David O Hara’s Income vs Growth article this month, the companies that are performing well on AIM at present are those that pay dividends. So it was particularly encouraging to see that Densitron has doubled its interim dividend this year to 0.2 pence per share. Healthy dividend increases are forecast for this year and next.

Code: Share price: Market cap: Sector: Employees: |

DSN 12 pence £8.3 million Electronic and Electrical Equipment 60 (at 31 December 2010) |

Outlook

Densitron Technologies is an international business with significant sales in Europe, the US and Asia. The Group is looking to increase its global reach and this is explained further in Chairman, Jan Holmstrom’s Outlook statement from the interim results:

“Although we are mindful of the general slowdown in the global economy, the outlook for the business remains encouraging. Our cautious optimism is due to the growing global demand for the products that the Group sells. Our strategy is to grow the business organically and we have concluded that this is currently the most appropriate way to expand our business. Whilst not ruling out strategic acquisitions we believe that the existing business can deliver greater returns and we are concentrating on growing the operating margin. We recognise that there are opportunities for geographical growth, with the office in Italy that was opened during 2010 already delivering a positive return. To that end we are intending to create a presence in India in the second half of the year with a view to opening an office in 2012. India is a location that has delivered a substantial number of leads during the first half of the year.”

AimZine Comment

Densitron is performing well, beating internal forecast for the first half of the year, despite the difficult economic conditions. The Group has a healthy balance sheet and potential for growth. Indeed, if Densitron can successfully achieve the growth forecast by its broker over the next two years then this could have the makings of an interesting long term investment.

As always, the purpose of this Snippet column is to highlight a particular situation worthy of further research and monitoring. Any reader wishing to learn more about the Group will benefit by reading the 2010 Annual Report and the recently released Interim Results which can be downloaded from Densitron’s website here.

opportunities for

geographical growth

Copyright © Aimzine Ltd 2011

Return to: September AimZine Front Page

y without prior consent. ADVFN will BAN those who post AIMwithout prior permission.

| Recent Aim Snippets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

This article is the copyright of Aimzine Ltd. No part of the article should be copied, reproduced, distributed or adapted in any way without our prior consent. |